Enhancing automated deal pricing amid policy changes

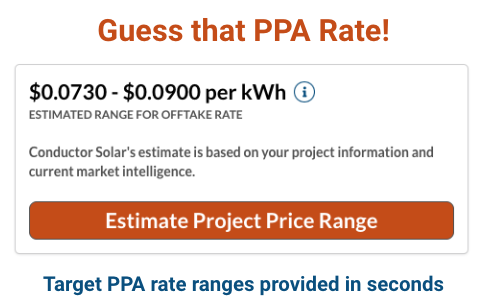

We just made some big updates to our pricing engine. This is the automatic estimate that EPCs and developers use to anticipate customer offtake rates and project values, primarily for PPAs and acquisitions for C&I and bilateral utility projects. With a handful of inputs, you can price a deal in under 2 minutes.

We’re working to expand automated pricing to community solar and BESS-only projects. For the moment, give us a ring and we’ll help create a custom estimate for those types of projects including the nuances below.

Our pricing estimates are informed by market conversations and recent bids from IPPs on our platform. With increasing deal volumes and relevant data points we’ve been able to fine tune the results. It’s a living, breathing machine that just grew in size and complexity…for all the right reasons.

We now adjust C&I project pricing based on customer credit, rated or unrated, because we know how IPPs price these deals differently. You don’t even need the customer’s financial statements. You only need to know whether or not they’re investment grade or the equivalent for unrated companies.

We’ve also made a number of updates to better align estimated pricing with new market realities under shifting federal policy:

ITC adders require higher investor returns. We’ve factored in varying ITC percentages and adders ever since the Inflation Reduction Act. We’re now adjusting pricing based on the specific adders included. For example, IPPs need higher returns if they are to claim a domestic content adder, and that premium varies based on the sector of the market.

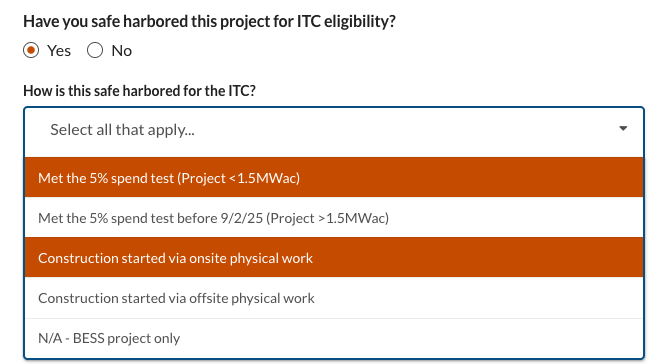

FEOC and ITC safe harbor status is critical to both pricing and investor demand. Our estimate now incorporates a project’s safe harbor status for FEOC and ITC eligibility. If you’re expecting an IPP to provide equipment for one or both of these, expect them also to price in the value of their planning and procurement.

No ITC? No problem! We’re now providing estimated pricing for projects not expected to be ITC eligible. These are not the focus today, but they will be soon. And the scenarios can help communicate urgency to C&I customers about the PPA rate impacts of missing ITC deadlines.

These new additions complement other parameters for estimated pricing including mounting type, geography, and project size. And we’ll continue to refine the pricing engine, as bids on the platform provide an increasingly rich data set with more nuances across different projects.

We’re seeing markets for project M&A and PPA financing adapt in real time to the phase out of the solar ITC as IPPs adjust their pricing based on their read of the policy risks. They’re also adjusting their investment goals. We’ve seen increasing interest in BESS as the anchor for ITCs and in operating portfolios that don’t rely on the tax credits.

In this dynamic environment, automatically pricing projects from 200 kW to 20 MW is a daunting task. But we’ve built a pricing engine that continues to deliver helpful guidance for developers, EPCs, and C&I customers and better align their deal expectations with the current market reality.

2025 year in review

Conductor’s 2025 year in review

Is 2025 over already? What a year.

Many of us in the renewables industry will be happy to put this one behind us. The year was not without new milestones and some pleasant surprises. But the news cycle and the deal cycle were dominated by anticipation of, reckoning with, and awaiting specifics of federal policy changes. The waiting game continues with FEOC top of mind.

Highlights for Conductor in 2025

Growth in our M&A deal volume and deal sizes

Growth in ITC transfers for C&I customers

Official launch of operating asset M&A in the app

Official launch of standalone storage in the app

Highlights for the industry in 2025

85% of new US generation capacity from solar and storage (Q1 - Q3)

Global renewables electricity production exceeding coal for the first time (H1)

Electricity prices front and center in US politics for the first time in decades

The bigger story

At a global level, the story is incredibly positive. The renewable energy industry is a juggernaut that even a retrograde White House and acquiescent Congress have struggled to slow down. From climate policy to PV and BESS production, the world moves ahead with China in the pole position. Amid rising electricity prices, nixing renewable tax credits is starting to look like an own goal at a national scale.

At the same time, our industry is planning beyond solar tax credits in two important ways. The first is with the BESS tax credits that slid through unscathed and have garnered new attention from IPPs. The second is with solar projects that increase efficiency and reduce costs by ignoring the ITC. While the day-to-day focus has been safe harboring projects for solar tax credits, new approaches for the future are emerging.

We’ve seen increased BESS M&A deal volume this year on our platform, both with standalone projects and paired with solar. We have not yet listed a project without an ITC. But we have used our market data to identify geographies where these projects already pencil. As electricity rates continue to rise, we anticipate more parts of the map fitting the category.

Prediction wins and whiffs

Looking back, our predictions for 2025 were a little off. We tried to anticipate the Trump administration’s impact on solar’s middle market, but our forecast didn’t quite match reality. Here are the biggest wins and whiffs from that crystal ball:

Best prediction: nation-of-origin equipment requirements for all projects using tax credits

Worst prediction: the idea that GOP reps might support solar over Trump allegiance

Biggest surprise: no early phase-down for BESS tax credits

Who you gonna call?

Our heroes of 2025 are states stepping up policy support. And we’re eager to see how the states respond to rising electricity costs, as the issue comes front and center. Data centers are an easy target and a real challenge, but they’re not the whole picture. We need more power for everything now.

In the words of Ray Parker Jr., “Who you gonna call?”

Coal and oil: plant retirements will exceed new capacity

Nuclear: new plants beyond pilots will take 10-15 years

Utility scale renewables: federal permitting hurdles

Gas: anybody got a turbine?

Developers and operators of DG solar and storage are standing by. Here’s to phones ringing off the hook in 2026 and beyond.

Thinking beyond the ITC

Marc, Aaron, and Vikram attended the NPM DG Development and Finance conference in NYC last week, where industry leaders expressed some very forward thinking and optimistic views on the future of DG in the US. Conferences, when done well, can be an opportunity to step back from day to day activities and envision the future a bit more broadly and longer term. On this score especially, NPM DG 2025 did not disappoint.

Marc joined the first panel on the future of community solar and DG and raised a question about post-ITC project economics. Over the last few months, our industry has been rushing to safe harbor projects and line up development and financing timelines to lock in the ITC. The question is, after the deadlines pass and new projects no longer quality, what comes next?

This prompted discussion throughout the day of what the post-ITC regime will look like and how our industry will need to adapt. In these conversations was a thread of not just optimism but genuine excitement about how our industry will evolve. Here are a few quotes that capture the sentiment:

“IRA exuberance seemed crazy”

“At some point you look at the ITC and wonder if the juice is worth the squeeze”

“We’re not far from no-ITC deals”

“It will be a positive thing, ultimately”

“I’m not for extending the ITC”

“Build projects as if you don’t have the credits”

“Don’t tell suppliers you have ITCs or adders - they will charge you more”

“It would be nice to get the tax lawyers out of the system”

Sorry tax lawyers, and suppliers. There was excitement about removing the complexities of tax equity and increasing efficiency throughout the supply chain. But it was all built on appreciation for the fundamentals, especially rising electricity prices from the grid and the declining cost of solar panels and batteries. Over time, these trends make more and more projects pencil without the federal tax credits.

Of the many many efficiencies in projects that do not seek the ITC, perhaps the greatest is reduced transaction costs of avoiding a tax equity structure. There are contracting and legal requirements here, pricing complexity, and an extra party in the capital stack with specific needs for diligence and approvals. ITC transfers have simplified this for some deals, but most transfers still happen alongside tax equity and all of its attendant requirements.

Another efficiency is flexible procurement. Over the last few years, ITC qualification has required prevailing wages for larger projects and specific equipment for the domestic content adder. FEOC requirements increase this complexity and have created additional uncertainty about qualification. Just imagine not having to deal with all of that.

A second order impact of these changes will be more capital entering the market without the constraints of attracting and contracting with tax credit investors. Tax credits have been so lucrative for so long that we’ve organized the whole industry around them as a scarce resource. When the industry no longer relies on that resource, and project economics work without it, more debt and sponsor equity will be deployed more efficiently to fund more projects faster.

In the wake of the big bill from Capital Hill, state governments have been stepping up their support for clean energy. These programs will help bridge the gap, especially in the interim, making many DG projects feasible without federal tax credits. This is also likely to concentrate project development in the states with these programs, at least for a while.

Kudos to NPM for a great conference and this opportunity to think together about the future of our industry. The road may be rocky en route to the post-ITC regime, but there is plenty to be excited about on the other side. Now let’s all get back to moving projects over the finish line so that we can harvest these ITCs while they last. Thank you tax lawyers, we really do appreciate you!

The future of DG solar and batteries

I recently spoke on a panel about scaling DG solar and battery storage in MISO. Amid several policy discussions, I framed my comments around a simple question: What are the growth drivers for DG solar and batteries, and how do these resources compete with centralized generation? Here’s what I shared…

The Near-Term Outlook

Recent policy shifts—think OBBB, FEOC, and the latest changes to “start construction” rules—have put some headwinds in front of solar and storage, particularly solar. As a result, 2025 and 2026 look like strong years for deployment, but by 2027 and 2028 I’m expecting a dip.

That said, I also believe this is temporary. By the end of the decade, the fundamentals will reassert themselves, and DG solar and batteries will begin to bounce back.

Why the Fundamentals Still Win

When you zoom out, DG solar and batteries remain one of the most attractive energy resources for three reasons: value, speed to market, and location.

1. Value

This is the deepest point. Solar and storage projects continue to offer compelling economics:

Build costs: While costs have ticked up recently, I expect them to decline 15–20% over the next five to six years. That’s thanks to equipment efficiencies, better engineering, and construction practices.

Financing: The industry is moving toward structures that require less reliance on tax equity—the most expensive piece of the capital stack. With simpler, more efficient financing, more investors will enter the market, bringing both liquidity and stability.

Efficient operations: Assets are becoming more efficient, both in generation and in how storage extracts value from the market.

Relative value: As utility rates continue to rise, fueled by massive transmission buildouts, solar and storage become more attractive alternatives for customers and investors alike. This value will only expand over time.

2. Speed to Market

Few resources can be developed and brought online as quickly as solar and storage. From permitting to interconnection to construction, DG resources have a timeline advantage over centralized generation.

3. Location

Solar and batteries can be sited close to load, making them strategically valuable and able to deliver benefits where they’re needed most.

From Subsidy-Driven to Value-Driven Growth

For most of the last decade, DG growth has been subsidy-driven. And that was necessary. It helped us scale the industry and prove the model.

But looking forward, the next ten years will be about value-driven growth. As solar costs decline, financing becomes more efficient, and utility rates rise, DG resources won’t just be supported by policy. They’ll stand on their own economic legs.

That’s a powerful shift.

This framing seemed to resonate with the room during the panel. I saw plenty of nodding heads. And I think it’s a helpful way to think about the medium- and long-term trajectory of DG resources in MISO and beyond.

Market update: new solar start of construction guidance

The Treasury issued their long-awaited guidance on Friday. It's a net negative for the industry, but was certainly better than some of us feared. Nuanced details matter A LOT for M&A, so here’s a link to the actual guidance from the IRS, which is fairly readable.

Here are our top takeaways:

It's not retroactive

Anyone who had previously taken safe harbor actions, or who take action in the next two weeks, may safe harbor projects under the previous guidance. 9/1/25 is the last day to take action.

Continuity safe harbor

If a project begins construction at any point in 2025, it has to be turned on by 12/31/29. If it begins construction between 1/1/26 and 7/3/26, it has to be turned on by 12/31/30. This maintains the snapshot approach for "beginning construction", as opposed to an ongoing burden.

5% spend threshold only <1.5MWac

Between 9/2/25 and 7/3/26, the Five Percent Spend Threshold will ONLY apply to projects <1.5MWac. We expect this nuance to maintain ~1,500 projects between 2027-2029. These will be both C&I projects and small community solar projects. Almost all of these will be <1.0MWac to avoid prevailing wage requirements and to stay under state programs thresholds for optimal value.

Physical work test for all projects

Whether offsite or onsite physical work, this will be the new norm. It will be needed to safe harbor projects between 9/2/25 and 7/3/26 which are greater than 1.5MWac (it also can apply to those projects under 1.5MWac).

Offsite physical work still qualifies

This is the cheapest low risk option for safe harboring a project. The industry will complete a lot of off-site physical work, such as issuing binding contracts for work to begin on custom transformers for a specific project.

Onsite physical work still qualifies

This was clarified in the guidance. Installing racking will qualify. Geotech, grading, site clearing, etc. will not. There will be gray areas here, and tax equity hates the color gray.

Here’s what this all means:

Site selection required on projects >1.5MWac

With the 5% spend test, it’s been common industry practice to buy equipment now and select sites after the deadline. Key stakeholders including tax equity and attorneys have supported this approach, and we expect it to continue for projects <1.5MWac.

But larger projects that require physical work, whether onsite or offsite, to safe harbor tax credit eligibility will need to have sites selected.

Crunch time

The rush is on to safe harbor projects. It will be particularly strong over the next 9 months for larger projects >1.5MWac that require site selection and physical work.

For smaller projects <1.5MWdc, we expect developers and IPPs to create LLCs safe harbored via equipment purchases for sites to be identified between 2026 and 2029. Here, the rush is on for equipment with eye on FEOC requirements.

OBBB and the DG market

Here’s our take on key provisions in the “One Big Beautiful Bill” that will impact DG solar in the US.

One thing that we can all agree on about the so-called “One Big Beautiful Bill” is its size. It’s massive. And amid the tax cuts, medicaid cuts, and broader impacts on the renewables industry are key provisions directly impacting distributed energy:

Negative: new cliff dates for the solar ITC

Negative: new foreign entity of concern (FEOC) restrictions

No change: battery ITC retained

No change: ITC adders retained

No change: Transferability and direct pay retained

Positive: 100% bonus depreciation enacted permanently

TBD: executive order overhang on redefining “start of construction” for solar ITCs

Our expectation is that these changes will accelerate some activities for solar projects and slow others:

Accelerated development, deal making, and site work to lock in construction start dates

Repricing everything that doesn’t meet the deadline, with some projects dropping off

Steady growth from there driven by rising rising utility rates

Solar ITC cliff dates

While it could have been worse, the end of the solar investment tax credit is still the biggest negative for our industry here. OBBB requires that a project start construction prior to 7/3/26 to lock in four years during which it can be placed in service. Otherwise the project has to be placed in service by 12/31/27. This is a drop dead date, similar to NEM 2.0 in California, which will not be easy to manage for any projects looking to hit COD within eight months or less from 12/31/27.

Beginning of construction

An executive order following the passage of the bill also raised questions about what exactly will be required for the start of construction. In the past, this has been met by spending 5% of the budget, e.g. on equipment, or starting physical construction on site. In mid August we expect to know if there will be substantial changes to these requirements or more modest modifications.

FEOC

The bill also introduced complex rules about a foreign entity of concern (FEOC) that make projects owned, controlled by, or in receipt of “material assistance” from a prohibited foreign entity (PFE) ineligible for the tax credits. China is the focus here, of course. And material assistance is defined as different but steadily more restrictive percentages of costs for facilities, technologies, components, inverters, batteries, and critical minerals. Expect ample work for accounting firms who diligence these percentages to verify eligibility, similar to what we’ve seen for the domestic content adder. And don’t expect this to happen overnight, we may see a major development slow down as soon as 1/1/26.

Percentage of non-FEOC material costs divided by total material costs, per Sidley.

ITC adders

The Domestic Content and Energy Community adders remain intact, though subject to the same cliff dates as the ITC generally. The Domestic Content threshold was clarified for projects based on project start dates:

40% before 6/16/25

45% between 6/16/25 and 1/1/26

50% in 2026

55% after 2026

Transferability and direct pay

OBB also retains tax credit transferability for businesses and the direct-pay option for nonprofits and governments. There is a new restriction prohibiting transfers to FEOCs, but most transfers and direct pay approaches should not be affected.

BESS

Battery storage projects will still be eligible for the ITC through 2033 and are not subject to the new cliff dates for solar projects. This is probably the biggest positive for our industry in the whole bill. The challenge here will be those increasing cost ratio thresholds for “material assistance” from FEOCs, with the threshold for battery components increasing from 60% in 2026 to 85% in 2030 and the threshold for critical minerals increasing from 0% in 2026 to 50% in 2033.

Bonus depreciation

One benefit from the bill is that 100% bonus depreciation was permanently reinstated. While not all solar investors can fully take advantage of that, some certainly can and will. This could help soften the blow of what’s likely to become a tighter market from buyers.

Conductor’s take

This bill is of course a big setback for the DG solar market following the momentum that had been created by the Inflation Reduction Act. It is also clearly not as bad as it could have been in the context of harsher proposals that received serious consideration in both the House and the Senate. Retaining the ITC for battery storage and the provisions for adders, transferability, and direct pay are all significant wins.

The biggest challenge going forward will likely be the FEOC restrictions, given China’s historic dominance in key equipment supply chains. Manufacturers are already adjusting, but it will take time.

We’re expecting accelerated development, deal making, and site work over the next year to lock in safe harbor for projects’ start of construction. Everything else will need to get repriced. Many projects will still be viable, especially as rates for electricity from the grid continue their steep climb.

Batteries with and without PV will continue to grow and improve with scale. But their value proposition in the DG market will continue to be driven by program and rate structures more than the merchant arbitrage opportunities driving their growth at the utility scale.

For more detailed analysis of the bill, see Sidley’s write up here.

Solar project M&A - Chaos on the buy side

Chaos on the buy side of solar project M&A is not new, but the highlights from 2024 are striking - especially for sellers unaccustomed to these patterns of change.

Did you feel like the IPPs in 2024 were all over the place? It’s easy to feel that way. This post highlights some of the chaos that we witnessed last year across the buy side of the M&A market for C&I and community solar projects. But we’ve actually come to expect this, having witnessed it year after year, and you probably should too.

As a platform supporting renewable energy project funding, we see a lot of deals. We also see the aggregate behavior of buyers and sellers and its patterns. Everyone knows the deals they’re working on and the behavior of those counterparties. But without more data points, it’s hard to know if those behaviors are unique to those parties or part of a broader trend.

This is especially true for sellers who experience shifts on the buy side. One moment you’re working with a buyer who prices competitively and seems eager to close, and the next moment they’re changing their price - and not for the better - or backing out of the deal entirely. What happened? Was it me? Was it them? Was it the project? Or was it a broader trend like rising hurdle rates across the market?

The only constant is change

We help sellers make sense of this kind of experience and find a new party to work with. But we’ve seen these patterns so frequently that we’ve actually come to expect them. And if we could convey one universal truth to all developers, EPCs, and project sellers across the middle market, it would be this: the buy side of the market is constantly shifting.

Highlights from 2024

Last year was no exception. We saw changes in pricing, changes in project size requirements, changes in timeline requirements for project development and funding, and even leading investors in specific market segments abandoning those segments entirely. Here are the highlights:

Multiple buyers across C&I and community solar raised their goal posts for deal sizes, dropping or postponing anything in their pipeline that didn’t meet the new threshold.

We consistently saw C&I buyers raise their threshold for investment from $1M, then to 1MW, then to $2M, etc.

A leading PPA provider abandoned their pipeline of all sub 1MW (or is it 2MW?) projects altogether

Multiple community solar buyers increased their minimum size threshold for transacting - often to 15-20MWs

Multiple buyers found projects that “no longer fit with their pipeline” and turned around to sell them, and we don’t believe that this was the original intent from most of these buyers

Multiple PPA providers abandoned the C&I market altogether

Multiple smaller buyers chose to focus exclusively on current year CODs, while many larger buyers chose to focus only on projects that would reach COD in 2025

Multiple experienced buyers who had previously focused on earlier stage acquisitions started buying projects at NTP

Multiple experienced buyers shifted to buying earlier stage community solar projects, as they found themselves routinely uncompetitive at the NTP acquisition timing

But was 2024 unique from prior years? Will 2025 be any different?

In short, no. This is the way this market has functioned historically and will continue to function. Sure, macro trends like policy shifts, interest rates, supply chain issues, and other changes impact everybody. But why do so many individual companies shift their focus so dramatically?

Our perspective here may be different from what sellers see in their interactions with deal origination teams at buyer organizations. These groups identify investment opportunities and move deals from a first conversation to pricing and LOI all the way through diligence to closing. We work with them too, they’re great folks. But they’re often surprised by the shifts at their own companies.

The decision making that drives dramatic shifts from buyers occurs among senior executives. It’s informed by the pricing, capacity, and timing of their capital sources, including debt and tax equity, along with their viewpoints on shifting market conditions. These are not decisions taken lightly. These teams are managing hundreds of millions or billions of dollars in institutional capital. But the market for those capital sources is dynamic too. And the solar coaster is fierce.

In a recent episode of the Open Circuit podcast, Jigar Shaw mentioned 9 commercial solar platforms for sale right now despite the strongest demand we’ve ever seen for solar and battery storage among commercial customers. He attributes this buying opportunity to mispricing in 2024, prior to the election - which itself is adding uncertainty. For all of these reasons, we’re expecting new shifts on the buy side in 2025, just like in 2024 and in previous years.

What to do about it

All of this points to the importance of having multiple offers from high quality buyers. Here are our recommendations for for sellers bringing projects to market in 2025:

Find multiple buyers who are a real fit for any given project or portfolio, not just “interested.” You should be able to tell which buyers are “interested” and which buyers are “hungry” for your projects or portfolio. You want to work with those who are “hungry” for it.

Assess their team’s eagerness and ability to execute alongside their pricing.

Leverage Conductor to do this efficiently and effectively for all of your projects across size, geography, and offtake type. Most sellers take a pulse on the market once or twice a year, we’re in this daily and it helps us accelerate the deal making on our platform.

Trump 2.0 and Solar’s Middle Market

How will GOP leadership of the legislature and the White House impact solar’s middle market in the US?

Leading up to the 2024 presidential election, a GOP sweep of the presidency, house, and senate seemed like a worst case scenario for the US solar industry. Control of the legislative and executive branches would give Republicans an opportunity to use legislative measures as well as executive actions to roll back progress on renewables, including Biden's signature Inflation Reduction Act. And, with Trump in the White House again, who knows what chaos might ensue?

Now that this scenario has come to pass, it’s worth taking stock of how the election results are likely to affect solar’s middle market. We’ve previously covered the impacts of the IRA, the non-linear benefits of ITC percentages on project values, and the impacts of ITC transferability on the market. This legislation has supercharged solar’s middle market over the last two years and is the first focus of our attention here.

Reasons to be Optimistic

The key to keeping the Inflation Reduction Act intact, or at least the core provisions accelerating solar’s middle market, is the House of Representatives. House Speaker Mike Johnson has said that it would be impossible to repeal the full IRA, and the only way to change it is with “a scalpel and not a sledgehammer”. 18 of his House GOP colleagues have urged for this publicly, and many others have in private as well. SEIA and industry leaders have indicated that there is no political appetite for a full repeal.

A big reason for bipartisan support for the IRA comes from its broad distribution of benefits across the country. The following chart illustrates how more solar capacity has been added in counties that voted for Trump than in counties that voted for Biden.

Historically, once a government program benefits certain constituencies it becomes very hard for Congress to take it away - especially when the constituency is broad and bipartisan. So there is good reason to be optimistic about the general stability of the Investment Tax Credit for solar projects.

Areas of Concern for the ITC

This all of course begs the question of what a “scalpel” would cut, and which parts of the IRA are most likely on the chopping block. Some of the top candidates for cuts do not affect solar’s middle market. These include EV tax credits and off-shore wind. Others would only impact specific types of projects in the middle market. These include the ITC adders for Low-to-Moderate Income communities and the direct pay or elective pay option for non-profit organizations.

The concept of Domestic Content aligns with GOP goals for US manufacturing, but it may become a requirement for the base 30% ITC on all projects instead of a bonus 10% adder to the tax credit. That would add costs for all projects while removing additional benefits for domestic components. We have not yet seen the Energy Communities adder considered as a priority for modification.

A greater long term risk to the middle market is the potential for an earlier phase-down of the tax credits, even as soon as 2027 or 2028. There are active discussions about this kind of timeline among the incoming administration. But it’s worth noting that such drastic changes have not passed congress, and seem rather heavy handed for a “scalpel” approach. If they are included, changes to the phase-down timeline may have the greatest impact on solar’s middle market in the long term.

The good news is that we may know how the IRA will change under Trump as soon as Q2 of 2025. Because of the way that the IRA was created, it can be modified through a budget reconciliation process. And this is likely to happen as part of a Republican effort to help pay for the extension of tax breaks from Trump’s first term, which are set to expire in 2025. Such a tax bill is part of a still broader Republican legislative agenda which faces considerable obstacles with a very slim house majority.

Other Areas of Concern

There will be tariffs on imports. And these do not require legislative changes and the approval of congressional representatives from the districts in the chart above. Despite a growing domestic manufacturing base, the US solar industry still imports most of its solar panels and inverters and will almost certainly be heavily hit by Trump’s tariffs, again.

The good news for the middle market is that distributed energy generation is much less impacted by tariffs than utility scale developments where the equipment makes up a larger share of project budgets. Tariffs will squeeze project economics across the board, but they are much more likely to make Gigawatt scale projects uneconomical than C&I, community solar, and small utility projects.

Grant programs are also candidates for the chopping block. And Trump will have broad authority to change political appointments at DOE and FERC. So forward-looking programs that support innovation and efforts at interconnection reform will likely be impacted, and may be stalled or derailed.

The Big Unknown

The biggest impact of a second Trump administration may come in the form of general uncertainty. This is terrible for business, especially in an industry built on long-term contracts. Despite the challenging changes ahead, we’ve heard a strong desire to get through them quickly so that we can once again know what we’re working with. Uncertainty can stall decision making, create delays, and sap momentum.

In his time away from the White House, Trump seems only to have enhanced his reputation as an agent for chaos. And he’s promising to deliver it in full force. So the biggest impact of Trump 2.0 may be what Donald Rumsfeld famously termed "unknown unknowns”.

How the Market is Reacting

So far, we’ve seen full steam ahead on deals in progress and strong interest in new deals on the horizon. The consensus is that good projects are likely to move forward, perhaps with some repricing and adjustments to accommodate legislative changes. This reflects industry optimism about the strength of the ITC and its broad support in the House of Representatives.

Reactions We’re Anticipating

In past rides on the solar coaster, we’ve seen accelerated market activity just prior to adverse policy or incentive changes followed by a slower period. Examples include previous ITC phase outs and the end of NEM 2.0 in California. We’re anticipating a similar pattern in the next few years, with its severity and timing determined largely by the extent of Republican trimming on the IRA. We could face a slower pace of growth for a spell, a plateau followed by more growth, or a temporary contraction.

None of these patterns will alter the fundamental trajectory of solar energy. But they will impact near and medium term market dynamics. If projects find themselves in need of new financing partners during these turbulent times, we’ll be here to help.

Concluding Thoughts

Despite some very good reasons to be optimistic about core policies supporting the US middle market, these are difficult developments. As of yet, we are not anticipating positives for the solar industry from GOP leadership. The conversation is all about anticipating the extent of the damage. Uncertainty makes these predictions especially difficult, but we’ve done our best to read the tea leaves here. And while we would prefer not to give Trump any more of the attention he seems to crave, it’s also important occasionally to address the elephant in the room.

Portfolio Construction

In project finance, the portfolio effect is well known. The tricky part is deciding which mid market solar projects to group together to make it work.

Developers and EPCs are almost always working on more than one project. But their projects vary by timelines, offtakers, locations, and pricing. This works fine for one-off cash deals and customer-owned C&I projects. But it creates a puzzle for third party ownership, particularly with portfolios.

In project finance, the portfolio effect is well known. If you can group a set of projects together into a portfolio, you’ll get better pricing from buyers. Economies of scale allow buyers to deploy more capital at lower cost per project, improving overall pricing for the portfolio.

The tricky part is deciding which projects to group together to make this work. If it were as simple as throwing any project into the mix, developers and EPCs could include their whole project pipeline from speculative origination through mechanical completion across C&I and community solar projects in seven different states. But investors don’t work that way.

Our investors are IPPs who manage funds that align with specific project profiles and specific time periods. This makes them interested in some projects and not others, and some projects more than others. And their priorities are constantly shifting in subtle and not-so-subtle ways.

For developers and EPCs, these dynamics make project financing feel like a moving target. One of the reasons they use our marketplace is to find the right investor at any given time. But these challenges are compounded in portfolios, where some investors will bid on more projects than others and different projects than others, creating a multi-dimensional matrix of potential bid configurations.

What makes a portfolio?

We’re frequently asked about the right portfolio construction, which projects to market together, and even what a “portfolio” means in the middle market. The right answer is the combination of projects that maximizes value for the seller. But the specifics of how to get there vary considerably.

Our software is very flexible for portfolio construction. We don’t have hard and fast rules for projects that can and can’t be combined. And we’ve found success in the market with a wide variety of portfolio configurations. But this experience has given us a perspective on the most important factors to consider when aligning projects for a portfolio acquisition. Here are our top five:

Counterparty consistency

Development status

Offtake type

Geography

Target COD year

Counterparties: Having as many similar counterparties across the portfolio is fundamental, as it creates economies of scale for the transaction. At a foundational level, this starts with the same seller, which is who ultimately controls all of the projects. For C&I projects, having customer consistency is the next most important (e.g. many different sites with the same PPA counterparty). Lastly, to the extent that EPCs are included in the portfolio, it is much more attractive to have a consistent EPC across the projects. The EPC is a substantive counterparty for the Investor to approve, with a heavier document for them to negotiate.

Development Status: Economies of scale also come from projects transacting at the same time in their development cycle (e.g. in development, NTP, mechanical completion). This allows buyer and seller to use the same contract documents and manage project execution similarly across the portfolio. It also creates more consistency in pricing. Financing sources change from year to year, or sometimes even within the same year, leading to potentially undesired changes for projects at different stages of development.

Offtake Type: Most investors specialize in projects with a particular type of offtake (e.g. C&I, community solar, or small utility). Some may be interested in both C&I and community solar, or both community solar and small utility projects. But we rarely see investors excelling with competitive pricing and execution efficiency across multiple offtake types. Even similarly sized projects within the same state may benefit from having different investors who specialize in the projects’ associated offtake.

Geography: The nuances of mid market solar projects at the local level are too many to list here. These include utility programs and interconnection, state subscription and incentive programs, permitting processes and policy structures. Investors are much more likely to lean into projects in places where they have experience or where their teams have done significant research. This allows them to move faster and with more confidence.

Target COD Year: It might be counterintuitive to see COD timing at the bottom of our list here, given tax credit financing’s outsized role in the solar industry. But investors buying projects in our marketplace manage multiple funds across calendar years, giving them flexibility. We do see price adjustments in LOIs tied to COD timing, so this is still a factor in pricing. But that doesn’t preclude projects in different calendar years being included in a portfolio and priced together, it just may have a slight impact on value for each.

Risk of imbalance

The two biggest questions on sellers’ minds are how much value they’ll receive from a sale and how likely their counterparty is to execute the agreement on the terms specified. Portfolios add complexity here because any projects that do not move forward will remove a portion of the portfolio’s aggregate effect on pricing.

If a portfolio includes several similarly sized projects and one falls off, the effect may be marginal. A buyer may even choose not to adjust pricing in this scenario. But if the portfolio includes a project that is much larger than the others, the impact of that project falling off can be dramatic. For a handful of different PPAs across a 2MW, 500kW, and 200kW project portfolio, losing the 2MW project can wreck the whole portfolio. By contrast, the impact of one project falling out of a large community solar portfolio is likely minimal.

This is a key reason why we ask buyers to price each project in a portfolio separately, as it provides clear evidence that some projects are worth more than others.

Market insight

With these multiple factors to consider, insight into buyers is extremely helpful. A portfolio configuration that works for one buyer may not work for another. Optimizing this to maximize value requires the right set of projects and the right set of buyers.

While a developer or EPC may take a few projects or a couple of portfolios to market every year, we take hundreds. We glean insight from 50+ IPPs actively bidding in our marketplace to inform our guidance on portfolio construction. This market insight doesn’t simplify the task, but it does help us construct a portfolio that maximizes value for sellers and works for buyers who can execute.

In some cases, we even have portfolios that receive bids on different projects from different investors. This flexibility in our marketplace allows us to see how the market responds to these configurations, and adjust accordingly. And it allows sellers to evaluate the costs and benefits of working with one party on the whole portfolio vs. splitting up the portfolio to align the projects with the focus areas of multiple investors.

How we can help

Our team will advise sellers on portfolio construction prior to bringing portfolios to market. We have deep transaction experience, current market insight, and an appreciation for the nuances of solar and battery storage projects across C&I, community solar, and small utility segments. We’ve aligned our own incentives with getting deals done and getting projects built, and our process supports these objectives for both sides of the marketplace.

Choose Your Own Adventure on Conductor

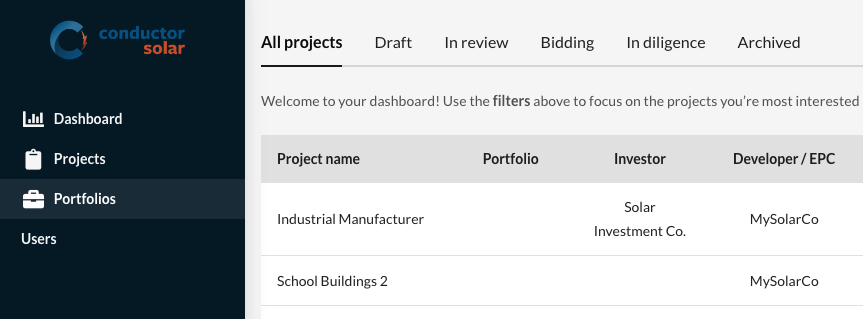

We’ve just released an update that gives everyone new flexibility to see the information that they want to see, assemble internal teams for each project, and invite collaborators from other organizations.

We’ve just released an update that gives everyone new flexibility to see the information that they want to see, assemble internal teams for each project, and invite collaborators from other organizations. Companies with large teams working on many projects will benefit greatly from this, and even smaller companies can take advantage of the new flexibility.

Up until now, everyone at your company had the same experience. The same projects showed up in the same order and everyone got all of the email notifications. For some of you, it was a lot of notifications - thank you for your patience! Now you can create project teams in the app, and focus your notifications on the projects that you’re working on.

Project teams

The next time you view a project in the app, you’ll see the new “team management” tab. This is the place where you can add a colleague to a project, and even invite a collaborator from outside of your organization. Maybe the project is now in diligence and needs someone else to jump in. Maybe there is a consultant, lawyer, or engineer from outside of your company who needs to help. You can invite these folks from the new tab. If they have an account on Conductor already, they’ll show up in the table. If not, you can send them an invite to set one up.

When you are a member of a project team you can choose to receive different email notifications about a project when you’re on the team.

Project leads

You can also assign project leads that will be visible in the marketplace in case someone needs to find your company’s point of contact for a project or portfolio. Project leadership can be re-assigned at any time - for example when the project moves to a new phase of financing or development.

If you’re a developer and you create a project, you’ll automatically be assigned as the project lead. But if you’re an investor that gets matched with a project in the marketplace, Conductor will need to assign the project to someone on your team. We’ve set up default project leads at your organization for this purpose, and you can edit these in your company settings.

External project team members

People joining a project team from outside of your organization will only have access to projects to which they’ve been invited by a member of your organization. You can invite them to as many projects as you like, and there are no limits on how many team members a project can have.

For example, if you’re a developer collaborating with an EPC for engineering services, you can let them update data and documents for your project directly in the app. Or if you’re an investor working with a lawyer to review contracts, you can give them access to project documents.

Notification settings

For large teams, this might be the best part. Based on your roles as a project lead and project team member, you can now choose which email notifications you receive on which types of projects. Maybe you’re a manager who only wants to check in periodically. Maybe you don’t want an email every time someone adds a document during the diligence process. It’s all good. Now you can decide which email notifications to receive based on your project role.

Choose your own adventure

The purpose of this update is to customize your experience on Conductor, focusing your attention on the projects most relevant to you and allowing your organization to manage projects more effectively. We hope you find the new features helpful, and we look forward to hearing what you think.

It’s a great sign for us that so many projects with so much activity in the app have people asking for these kinds of controls. This update will also lay a foundation for our future growth, allowing us all to manage more projects in the marketplace more effectively.

Market Snapshot: PPA Investor Growing Pains

We’ve been tracking acceleration in solar’s middle market since the passage of the Inflation Reduction Act. Rather than an immediate burst, this growth has come gradually as policies have been clarified and implemented. We noted how this momentum was stretching the existing capacity of developers and investors last fall. These challenges have compounded through the first part of 2024. We’re taking a moment here to share our insights on where the market is, where things are headed, and what it means for developers and EPCs.

US middle market picking up steam

The biggest factor driving market acceleration so far is the gradual clarification of investment tax credit adders by the IRS. We’ve provided updates on IRS guidance before. Here we’ll focus on the three primary adders impacting PPA project pricing:

Energy Communities. The clearest and most reliable adder so far, energy communities are well understood by the market and routinely priced into financing. The key wrinkle is that some of these qualifying territories can change, so developers and investors may need to ensure that projects start construction in the right year for qualification.

Low to Moderate Income. LMI bonus credits are great, if awarded. But they are limited in quantity and about 10x oversubscribed in most categories. So qualification doesn’t mean much until the project award is received.

Domestic Content. This one has been a sleeper so far. Equipment manufacturer reticence to open their books is understandable, but it has kept most of the market from incorporating the DC adder. We don’t expect it to become a regular part of project pricing until at least 2025, maybe 2026.

A new source of momentum this year is the EPA’s $27B Greenhouse Gas Reduction Fund. With the recent announcement of $20B in awards, we expect funds from this program to start flowing into the market in the 2nd half of 2024.

The upshot of these gradual rollouts of federal incentives is steadily building momentum and a steadily growing volume of viable projects. While great news for the industry, this does create growing pains for the companies working to deliver these projects.

The squeeze on investor bandwidth

The limits on investor capacity that we noted in the fall have come back with a vengeance. We’ve seen this show up in a number of ways recently, including:

Significant hiring, particularly for investor sales reps and the build-out of origination teams to support the increased project activity.

Tightening criteria. Investors are focusing on a narrower set of project types and being more selective as to what’s a “Grade A Project” for them. The low end of an investor’s target project size has tended to creep higher.

Slower response times. More investors have struggled to hit their bid deadlines or taken more time to follow up on diligence reviews.

Investors mentioning how busy they are. We are hearing this more consistently and from more parties than normal.

What this means for project financing

With a broad view, these trends are understandable. But for an individual project, the experience is bewildering. Investors that used to be a fit and a reliable partner may no longer be interested, or may require more vigilance to keep their attention. Things can change mid stream, and rapidly. We’ve even seen investor origination teams caught off-guard by shifts at their own companies.

In this context, it’s important to remember that the fit between a project and an investor has several dimensions, including:

Competitive pricing and deal terms

Ability to execute and close deals on the terms initially proposed

Speed to close and responsiveness throughout the process

Developers and EPCs may encounter challenges at any point. And because they lack visibility into the inner workings of investment companies, it’s very difficult for them to see these changes coming. But the impact on their projects can be significant.

How developers and EPCs should respond

At the start, it’s important to get multiple offers from high quality investors. The right investor for the next project may be different than the last one. And you can’t really assess this without seeing an offer and comparing it to others in the market. Beyond ensuring a good fit and the best pricing, multiple offers also give developers and EPCs backup options in case something goes wrong. This is especially important when market shifts catch teams by surprise.

In bidding and diligence, developers and EPCs should pay close attention to responsiveness and follow-through. It’s reasonable to expect transactions to take a little longer. And some patience is important as investors work to staff up. But they still should be following through on deals in process.

Fortunately, we’re seeing great follow-through from our top investor partners, even if closing takes a week or two longer than in the past. When investors are willing to make an offer, they’ve typically shown an ability to transact on the project or portfolio.

Where this is all headed

Is this trend here to stay? Yes, very likely. The market is feeling the momentum of the IRA now, but it’s still gaining steam. As the Domestic Content adder and the Greenhouse Gas Reduction Funds really start flowing, we expect these trends to accelerate and exacerbate the current challenges.

It will take time to scale execution efficiency. Investors will be adding staff, new partnerships, and software solutions. Conductor will continue to advance our marketplace and our diligence tools to help investors become more efficient and more capable of handling larger and larger project volumes. The Conductor process starts with finding great partners and finishes with tools that help those partners transact and collaborate effectively all the way through to closing and construction.

Introducing ITC Transfers

What’s new?

Conductor Solar now supports ITC Transfers for C&I and community solar projects! Building on the success of our marketplace for PPA and lease financing, we’ve created a marketplace for developers and EPCs to facilitate tax credit transfers for their customers’ projects and to directly sell tax credits for projects that they want to own and operate.

What is an ITC transfer?

The Inflation Reduction Act of 2022 included a provision allowing a transfer of the federal Investment Tax Credit (ITC). Previously, monetizing the ITC often required wither a) a certain type of tax liability, or more commonly, b) a complicated tax equity legal structure. While it’s still challenging for many to use ITCs, solar owners can now sell their federal tax credits to tax credit buyers via a much simpler structure - a one time transfer (purchase and sale).

How does Conductor help?

Conductor connects developers and EPCs with interested buyers and provides a suite of software tools and legal documents to facilitate the transaction. The software organizes project information to support pricing, diligence, and closing. And the recommended documents offer both parties a template for the term sheet and purchase and sale agreement for the transfer. We created the recommended documents in collaboration with a top tier law firm that is annually involved in the finance and sale of approximately 15 Gigawatts of renewable energy.

How will this impact the market?

We expect ITC transfers to unlock financing for a large number of new C&I solar projects with project values ranging from $50k to $10M per project. For-profit companies with limited tax liability can now consider solar energy system ownership as a viable option. This is true for both customers seeking to own their own systems and for developers seeking to provide PPAs and leases to their customers.

What about nonprofits and governments?

Nonprofits and governments don’t need to transfer ITCs because they can get paid directly by the IRS. This “direct pay” option allows these organizations that don’t pay federal taxes to receive cash from the IRS for the value of their ITCs. We are expecting these payments to come through after projects get built, so there may still be a financing need during the construction period along with any financing required for the remaining value of the system.

Tell me more

For more information, see our coverage of the Inflation Reduction Act:

How to Use Conductor

Conductor Solar is a marketplace where developers and EPCs find the best financiers for their C&I and community solar projects. We match projects and portfolios with investors by deal size, geography, customer type, and other factors to make everyone’s efforts focused on deals with the highest likelihood to close.

To do this, we collect project information from developers and EPCs and review every project before it gets matched with investors. We make sure the project economics work and the production estimate is reasonable. And we screen for common data errors and areas of misunderstanding. Our team has helped finance hundreds of C&I and community solar projects. We’re focused on saving time and money for everyone in this market.

As a developer or EPC, you can follow these steps to finance your project on Conductor:

1. Enter project details

Create a new project from your dashboard and fill in the required data fields. Documents are optional, but they can help - particularly with more unusual or complicated projects.

The required fields include the data points that investors will need to price a project. They’re organized by the main categories that drive economics including the project’s budget, revenue, and expenses. Conveniently, these are also the same data points that you can use to estimate pricing yourself.

2. Get automated price estimates

Once the required data fields are completed, “Generate Price Estimate” on the project summary page will give you a range for where the winning bid from an investor is likely to be. We find these ranges to contain the winning bid about 90% of the time for PPAs and leases, whether you’re looking for investors to bid on the project value (EPC cost + development fee) or the offtake rate (e.g. initial PPA rate per kWh).

3. Submit your project

When you’re ready to connect with investors for bids, submit your project for review. Our team will take a look and follow up with any questions within a day or two.

4. Connect with investors

We’ll connect you with up to five investors that fit your project and your objectives. Once matches are made in the marketplace, both sides can reach out and discuss the project in more detail. This is a chance to get to know who you’d be working with and clarify any outstanding questions that might impact pricing.

5. Compare your bids

Conductor sets the bid deadlines for investors, and they do a pretty fantastic job at providing bids within those deadlines for most projects. The ones that take longer have unique features that require more investigation like advanced microgrids, technologies beyond solar and battery storage, and new types of community solar revenue streams. All bids are based on the information provided by developers and EPCs, which Conductor organizes in a consistent way.

Comparing your bids involves more than just reviewing the numbers. Other factors to consider include the extent of the diligence process, vendor requirements, contractual restrictions, and the financier’s experience with particular project types. Our team will help surface these considerations so that you can make an informed decision.

6. Select a partner

Choosing an investor for a project is as simple as clicking “Accept Bid” in the app. This will tell us that you’ve chosen the group that you want to work with, and we’ll bring into further workflow tools to help everyone manage the data room for the diligence process. The more the documents area is already populated, the faster closing can be.

Interested in learning more? Check out our most popular articles on C&I solar finance:

Introducing Conductor’s New Look

Welcome back! Things may look a little different from the last time you stopped by. We’ve made a number of updates to the “user interface” here - a fancy word for what you see in the platform.

The core functionality of Conductor Solar is the same. We’ve added some new features and moved things around a bit. But projects are shared with investors in the marketplace just as they always have been.

Here’s a summary of what’s new:

Project setup: tailoring information to specific project types

Community solar: explicit questions for that project type

Battery storage: another one, do you sense a pattern here? :)

ITC transfers: a whole new way to monetize the ITC

Documents: more information, new display, and easier to navigate

Navigation: find everything you need, no matter where you are

Project Setup

Project Setup is now the first section in project data and captures elements that determine what you’ll see on the subsequent screens. Think of this like a configurator; when you make changes here other data fields change, too.

For example, a community solar project looking for a sale at NTP needs different information than a behind-the-meter customer owned project looking for an ITC transfer. Project Setup tailors the rest of the data fields, and makes them relevant to the project and the type of transaction that you’re seeking.

Community Solar

We’ve been helping developers find the right investors for community solar projects for years. But it’s always been a little imperfect in the software. With this update, we’ve added dedicated fields for community solar offtake and subscription management. And we’ve laid the groundwork for more community solar specifics in the future, for example by State and program.

Battery Storage

As adoption of battery systems has increased, so has the need to finance these systems. We’ve added batteries as a technology type, so that developers and EPCs can specify system sizes, O&M arrangements, and other key system features that influence investor pricing in the marketplace.

ITC Transfers

Okay, we totally buried the lede here. Conductor now supports ITC Transfers! There is a lot more to say about this, which we cover in a dedicated post. For-profit end-customers, developers, and EPCs can all sell tax credits to help finance new solar energy systems. And we’re building ways to make these transfers effective for the middle market.

Documents

Our file sharing system is completely customized to your project. Add placeholder containers, drag and drop files, and give access to investors when you’re ready. As a developer or EPC, you’re in full control of which documents are included and who gets to see them.

The Documents section now has folders on the left and files on the right, so it’s easier to click through and see the status of each document at a glance. And you can now edit the document list on the same screen to configure the listed files any way you want.

Navigation

The biggest change you’ll notice is probably the new site navigation. We’ve added a left-hand menu to find projects and portfolios along with notifications and user settings. This makes it much easier to access things, no matter where you are or what you’re doing in the app.

Another change with navigation is sub-menus for project data. Within overview, budget, revenue, and expenses the sub-menus make it easier to navigate to all of the data fields and reduce the amount of scrolling required.

Messages, which were previously in the project summary, now have their own section. This makes them easier to find and will enable some great new messaging features in the New Year.

More to Come

This update is also important beyond these specific improvements. The new user interface lays the foundation for the rest of our roadmap and will accelerate our development of new features throughout the app. What you see on a page is really a language of interrelated visual elements. We’ve built a lexicon here so that we can write software better and faster. So we’re excited to share this update, and equally excited for what’s to come.

Macro Update on Project Hurdle Rates

The Fed has been increasing interest rates to combat inflation since Q1 2022, including four hikes already this year. The most recent one was in July, so why is the industry all of sudden buzzing with concern about hurdle rates rising and project buyers having to renegotiate deals?

The Fed has been increasing interest rates to combat inflation since Q1 2022, including four hikes this year. The most recent one was in July, so why is the industry all of sudden buzzing with concern about hurdle rates rising and project buyers having to renegotiate deals?

In the past month, the Conductor Solar team has heard that “project hurdle rates are going up” at least a dozen times, which is more than we heard that phrase in all the prior months of 2023 combined. Projects and portfolios are coming back to the market more often than usual, and developers aren’t seeing the value that they once thought was possible. This sudden change is frustrating and it doesn’t make sense on its surface when you compare it to the consistent Fed rate hikes over the prior 18 months.

The question we get asked most often is: if the fed funds rate has only risen 0.50% since May, why are project returns getting hammered? The easiest way to answer this is by looking at the 10-year treasuries rate, a better benchmark for solar project return targets.

Source: fred.stlouisfed.org

Why is the 10-year Treasuries Rate a good benchmark?

Solar projects have a long life, typically 20-35 years. Most revenue contracts are in the 15-25 year range. Projects are typically financed with some mix of sponsor equity, project debt, and tax equity. For simplicity, let’s assume the following mix of those three sources:

As you can see above, approximately half of a typical solar project is financed by debt. Debt is sized based on the contracted revenues of the project and the weighted average timing for those cash flows tends to be around the 10 year mark, which is what makes the 10 year treasuries a good comparison for project debt pricing.

How does this impact the project’s hurdle rate?

When we talk about a project’s “hurdle rate,” we generally mean the unlevered IRR. This is the return metric that doesn’t care about how an investor finances the project and is what Conductor Solar uses to estimate its autopricing. This is the true north for a project’s valuation, and is a simplified way to view the world that works the majority of the time. However, since investors really do care about their equity returns, it makes sense to dig a level deeper here. We’ll highlight how the market forces are impacting each of the key parts of a solar project’s capital stack.

Project Debt: This is what’s impacting rates the most. As you can see in the 10-year Treasuries chart above, that pricing has increased 1.40% in the past few months. While other factors are at play, it’s safe to assume that the cost of debt for solar projects also has increased by 1.40% in the same period.

Tax Equity: For purposes of this article, we’re going to keep things simple and assume that tax equity is unchanged. There is reason to expect some tightening here too, at least in the short term, and we’ve seen some evidence to this effect. But the tax equity market is very dynamic right now in the context of these macro trends and the recent introduction of tax credit transfers.

Equity: This is the riskiest part of a solar investment, as it is repaid last after debt and tax equity. Investors in solar project equity often compare its returns with other general asset classes. As it becomes easier to invest in things like 10-year treasuries to earn a decent return, it means that the equity for solar projects needs to provide slightly higher returns to continue attracting investment. While this lags a bit behind the 10-year treasuries rate, the general impacts from rate hikes over the past 18 months are starting to show through here, too.

The Bottom Line

The impacts of all of these changes are that the unlevered IRRs for solar projects are increasing by ~1.00% in order to continue attracting project buyers. That can have a pretty dramatic impact on a project’s value, upwards of a 7-10% reduction on the total project value. If you’re a developer who waited until the project was fully derisked, you might find that your project isn’t commanding anywhere near the value that you thought it would.

Guidance for Developers

If you run into trouble with a project, use the Conductor Marketplace and find new offers

If you’ve signed an LOI but have not yet contracted, confirm your investor’s pricing

Have patience with investors, who are doing the best that they can while the cost of their money is constantly changing

Guidance for Investors

Keep every commitment that you can, to maintain credibility

Communicate early and often if something in a deal needs to change; and be transparent demonstrating why - so it’s clear to your developer that this isn’t just a grab for more value

Expect that developers will seek alternatives, and keep their loyalty by continuing to be a great partner in every way possible

Conductor’s Take

An inherent asymmetry is present once exclusivity is granted; developers rely on their investors to be credible, trustworthy, and to follow through on their offer

Investors get a bad reputation if they exploit this asymmetry with great offers during bidding that get rolled back during diligence. Bait and switch.

That’s not what’s happening here, for the most part. But it probably feels the same to many developers.

Conductor screens investors and works with high integrity shops who price competitively and follow through with solid execution. This is very hard to screen up front, which is why we leverage our insight into their behavior through dozens of deals with different parties. And this is very valuable for our developers, especially when they’re looking for a new investor partner.

Anytime Data Room

This fall is shaping up to be super exciting for product updates at Conductor. We have a couple of big ones coming in a few weeks. To kick off this season here’s a nice addition to the marketplace: data rooms for projects at any stage.

Most people see data rooms as a place to share files, but they can be so much more. We’re making data rooms sexy. That’s right, you never thought you’d hear it, but it’s true. And as a key foundation for any solar deal, a good data room is more important than most people realize.

A big problem with data rooms is that each party has their own file structure and naming conventions. But in this industry we don’t all speak the same language. Misalignments on file structures and file naming are silent killers of solar deals, and that’s a sad sad thing.

We’ve pulled from years of slogging through diligence on billions of dollars of transactions with dozens of counterparties to create something specific to the solar industry: a consistent file structure and naming convention for every deal in your pipeline. And we’ve added tools to make sure that nothing is lost in translation, like automatic remaining of files for all parties.

Our estimate is that deals using our data rooms close 10% faster and 1-2 weeks sooner, saving over 50 person-hours across the deal. Developers and investors doing deals on Conductor love these features, but up until now they could only access them after a bid was accepted. Now developers can use data rooms for all of their projects, even before getting bids.

What We Heard

It’s pretty common for investors to ask developers for project documents before bidding. Knowing certain details or having confidence in certain aspects of a project can impact their pricing. We noticed this behavior a few months ago, and quickly added a lightweight version of document sharing in the app. But everyone asked for more. A doc or two isn't hard to manage with a simple drag and drop, but unique and complex deals benefit from more structure.

Developers also asked for a way to organize documents for their own teams. Long before they engage with investors, developers manage project documents. Wouldn’t it be great if they could use the same data room that an investor uses later on? Bingo.

What We’ve Built

Worst kept secret: this is not a new feature! We had most of this functionality in the app already. We had just been hiding it until a bid was accepted in the marketplace. Shame on us.

We had to tweak a couple of things in the data room to make it work earlier in the deal, like who does what when. Developers can now set up their own data room while they’re drafting a project or getting bids. They can decide who sees the data room and when. Once a bid is accepted and the project moves into diligence, everything that the developer sets up becomes a great starting point for the investor. An investor can modify the list of documents and manage document approvals, with the added benefit of already having some docs in place.

So, one developer wants to use the data room internally until they select an investor - all good, that's the default. Another wants to share docs with an investor after signing an NDA - easy. Another wants to share a few docs with all active bidding investors - simple. What about just sharing one doc with one investor? We’ve got that too. Until a bid is accepted, developers have full control over who sees their docs and when.

Consistent across these timelines and all of these scenarios is our file structure, automatic document renaming, and the flexibility to select common documents and add custom documents. And we make it easy to see a status snapshot at-a-glance:

What Comes Next

So much to say here! Our data rooms will only continue to improve, and we really appreciate the feedback we’ve received so far. We’ll keep adding features and functionality and make data rooms sexier than anyone could have ever imagined.

In a few weeks, we’ll be sharing more product updates. Conductor supports a huge variety of solar projects, from a 50kWdc rooftop to portfolios of 5MWac community solar ground mounts with and without battery storage and all across the country. We’ve managed pretty well so far fitting all of these things into one platform. We’re about to make it easier to manage for everyone.

Insights from RE+ Las Vegas

What a week! Marc and I attended RE+ in Las Vegas last week, and it was bumpin’. Last year the conference had 27,000 attendees and this year had more - we heard estimates between 35,000 and 50,000, with 40,000 as the most common. Wherever the official number lands, it felt massive.

The Venetian Convention and Expo Center is so big that it can take 10 minutes to walk from one end to the other - assuming that you know where you’re going. But the place is a warren, and some people didn’t have cell phone reception. Our hit rate on back-to-back meetings was about 70% - not bad, actually. Lucky for us, our hotel didn’t get hacked. Not so lucky for some of our friends, and not the kind of luck you want to try in Vegas.

Industry Growth

It was a great year to be at the conference. The solar industry is growing rapidly spurred on by the Inflation Reduction Act. EPCs, developers, and investors are busy with deals in process and big plans for 2024 and 2025.

That growth is exciting but it comes with some challenges. Every company we spoke with is at or very near its maximum capacity. Developers are pushing forward on many projects all at once. Investors are financing these while also raising their next rounds of funding. We’re particularly attuned to a few late-stage project acquisitions targeting COD in Q4 - very important for all parties to align on these timelines.

Industry momentum is palpable, with deal activity and record breaking forecasts. One of the few places with a different near-term trend is behind-the-meter projects in California, where NEM 3.0 has put the brakes on solar-only projects and supercharged storage solutions. We’re excited for the long-term there too.

ITC Transfers

We’re hearing consistent themes on ITC transfers as as we get ready to enable these transfers in the marketplace in Q4:

Everyone is excited for transfers to happen

There’s lots of deals in flight but very few will close in 2023

Most deals are supported by insurance

Partial transfers are common, particularly with larger projects

With the IRS registry not anticipated to launch until December, it’s no surprise that quite a few buyers and sellers are waiting until 2024 to jump in. The proposed guidance released in June has helped, but it hasn’t resolved every issue. The most buzz about a potential variance from that June guidance is focused on the possibility that the IRS might allow purchased credits to offset active income. This would unlock a whole new set of buyers. But it would be a drastic change and it seems unlikely at this point.

Other RE+ Musings

Along with all the productivity came some great moments shared with friends. Here’s a sampling of what went down behind the scenes:

Our most common meeting spots were not in the Expo hall; they were scattered throughout the resort. One was a giant “Love” sign in front of an atrium waterfall. Another was an indoor replica of an open-air market beside a river with gondola rides. It almost felt like getting outside.

One of our partners lost his shoe. It literally disintegrated under his foot while we were meeting with him just steps away from a shoe store with fine Italian leather. Do resorts plan these things?

We found the perfect remedy for the desert heat: an ice bar! It is a bar within a freezer with glasses made out of ice. They give you coats and gloves to borrow so that your glass can melt right through your gloves and freeze your hands. All of a sudden that desert heat was sounding pretty good again.

We heard some great stories from Solar Fight Night, but this event continues to elude us. For general awareness, 10pm-2am Pacific Time is 1am-5am Eastern Time. Hats off to all East Coast attendees who made that one!

Marc, our CEO, got lost in the expo hall for 20 minutes trying to find the exit. When he finally emerged he had scored a teddy bear, heard a mariachi band, and been offered about 34 different beverages along the way.

Next year is back in Anaheim and we’ll see everyone back at the Venetian for RE+ 2025. We’ll set the over/under on attendance there at 60,000. Book your rooms soon!

The Inflation Reduction Act - Current Guidance

A year ago, senators Chuck Schumer and Joe Manchin reached a historic deal to advance the clean energy economy in the US. The Inflation Reduction Act was signed into law in August 2022, but the administrative guidance for the legislation has taken months to clarify. Of particular interest to the commercial and community solar industry are the requirements for federal Investment Tax Credit adders, direct pay, and transferability.