CA NEM 3.0 - C&I Implications

Last month we highlighted a number of positive developments in the middle market from the second half of 2022. Literally the day after we published that post, the CPUC made their final decision on NEM 3.0 in California. It wasn’t what most people in the solar industry wanted. But we’ve put together a few notes to explain what it did, what it means for California’s middle market, and why this is important for anyone in C&I solar.

Here are the highlights:

NEM 3.0 makes customers’ exports of electricity to the grid much less valuable than imports from the grid, except for a few hours in the evening when the sun isn’t shining

This makes battery storage a key compliment to PV systems, and a big part of the economics of any new installation

Once these rates take effect, we expect a shift to a) smaller PV system sizes and b) more batteries paired with PV in behind-the-meter installations

A Little Bit of Background

At Conductor, we help solar developers across the country find and transact with high quality investor partners. We serve the middle market - everything between residential and utility scale, including commercial, C&I, and community solar projects.

NEM 3.0 will impact behind-the-meter installations in CA. In the middle market, this mostly applies to rooftop installations serving businesses, governments, and non-profit organizations. But the change is so drastic, and California’s market is so big, that it’s worth considering the broader implications.

NEM 3.0: What it is and what it does

On December 15th, California made a big change to the way that energy is priced at the edge of the electric grid. This “Net Billing Tariff”, better known as Net Energy Metering 3 or “NEM 3.0”, changes the amount that customers get paid when they send electricity back to the grid.

At any given moment, a customer might be importing electricity from the grid (and paying the utility for it) or exporting electricity to the grid (and getting paid by the utility for it). In many locations with net metering policies these rates are similar, if not identical. In California they’ve been similar too, but they’re about to get wildly different.

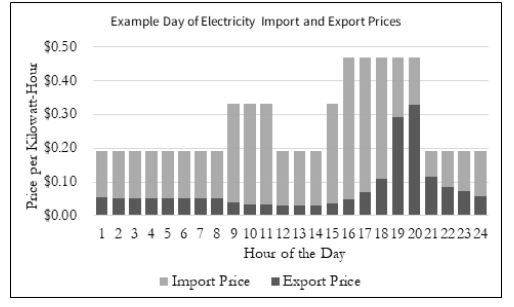

Here’s a graphic from the California Public Utilities Commission that illustrates the spread between import and export prices in NEM 3.0 at different hours of the day:

The lighter gray bars are the import price - what the customer pays the utility. The darker bars are the export price - what the utility pays the customer. But this is a simplified illustration. In practice, rates will be different at different times of the year and change year to year.

The Challenge for Solar Energy

For solar energy, this is a problem. The sun shines during the middle of the day, when export prices are lowest, and sets before the evening hours when export prices are highest. Owners of solar energy systems won’t get much money for sending their excess electrons back to the grid when they’re produced. And the amount of money that they do get will vary, which adds complexity and uncertainty.

This is why the industry opposed these changes so strongly. Now that the changes are decided, we expect a couple of trends in the way that systems are designed and built. That is, after a mad dash for interconnection applications prior to the middle of April 2023, when these changes take effect.

Trend #1: Smaller PV Systems

Solar energy systems behind the meter help customers in a couple of ways. The first is to offset on-site consumption by replacing electricity from the grid with electricity from the PV system. This will still happen at the import rate (see lighter gray bars above). As long as the power from the PV system is used on site, which we call self-consumption, the customer saves money at the higher import rate.

A challenge with this approach is that PV systems designed for self-consumption are much smaller than systems also designed to export. A typical net metered system before NEM 3.0 might have exported about half of the energy that it produced. But to not export energy to the grid requires a system even smaller than half the size.

C&I projects can still be economical with smaller PV systems, and can still get financed. At Conductor, we’ve helped projects as small as 25kW get PPA financing. But it’s harder for customers to get motivated about a system that impacts a small fraction of their electric bill.

Trend #2: More Batteries

Batteries store electricity for use at a different time. When coupled with solar installations they can store excess electricity produced during the day and use it at night - either to offset grid imports in the evening or to export to the grid when prices are highest. Either of these approaches can increase the size of a PV system; they allow the customer to monetize more solar energy at higher rates.

The challenge with batteries is that they are built for specific applications. A battery designed to cycle every day, charging for 8 hours while the sun is shining and discharging for 8 hours after the sun goes down, is very different from a battery designed to export power to the grid for 2 hours during a pricing event that happens a few months out of the year. Chemistry, power electronics, and programming are all optimized for specific charge and discharge cycles - especially with larger systems.

So, we do expect more batteries paired with PV systems under NEM 3.0. But it remains to be seen how many of these are used for self-consumption vs. grid export.

The Bigger Picture

The next time you see a C&I developer who works in CA, buy them a drink. California is already first in line for the Wildest Solar Coaster of 2023, and the year has barely started. Customers who submit interconnection applications before the middle of April can lock in NEM 2.0 - and have every incentive to do so. So we expect a big rush in the first part of the year, followed by a new normal.

This change will be abrupt and disruptive for the market in CA, but it’s unlikely to be an isolated trend. As battery prices decline, distributed solar’s share of generation on the grid increases, and rate structures evolve over time, more and more projects across the country will have to wrestle with similar considerations. There will be a lot to learn.

So thank that developer in CA for leading the charge.