Guess that PPA rate! Key pricing variables in solar deals

We've found that experienced developers can get pretty good at anticipating PPA rates for their customers. They know the avoided cost of power, their cost to build, and the approximate production yield in their target geography. But when they step out of their sweet spot, their ability to predict a PPA rate goes a bit haywire!

We introduced a new game this year at the NABCEP conference: “Guess that PPA Rate!” Players rolled a dice three times to determine system size, production factor, and build cost for a mid market PV system. Then we asked them to guess the associated PPA rate.

It was not easy! We did have a few players guess a rate in the proper price range, but the vast majority were well outside of the targeted range.

The engine behind this game is our auto pricing tool. For every scenario, Conductor ran a financial model in seconds. We took these three basic inputs:

And these generated PPA rates between $0.037 and $0.256 per kWh. To make this game work, we held constant a number of other variables which we’ll outline below. But the variety generated with just these three variables was enough to challenge some of the most experienced people in the solar industry. Why is this?

We sometimes get asked where PPA rates are at the moment, as if we could just quote them like interest rates at a bank. But mid market PPAs don’t work that way. Rates are different for every project, and we see viable projects priced at both ends of the rate range above. Furthermore, most people in the solar industry are really familiar with only one part of the market. It’s almost like you need a computer to answer this question for any given deal.

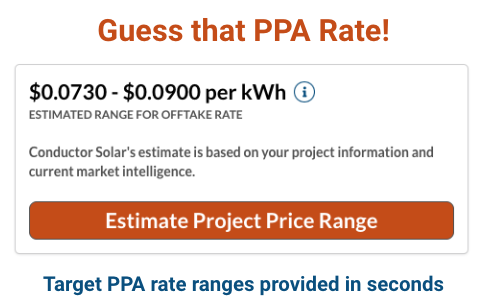

Bingo. That’s why we created auto pricing. The following are key variables that tend to have the biggest impact on PPA rates:

System size

Production factor

Build cost

PPA term length

PPA escalation rate

Federal ITC %

REC ownership and value

Upfront incentives

Site lease cost

Property taxes

O&M cost

Insurance cost

Development status

Our model uses these and other inputs to generate an expected rate range for a project’s PPA. We can run it in reverse to generate a build cost or budget based on an offtake rate, and we can model leases and ESAs in addition to PPAs. But it’s fairly complex, and way more accurate than guessing by humans - even us.

Each variable impacts PPA pricing to different degrees. But we can group them by category and identify which way a PPA rate moves when a particular variable increases:

To be clear, the PPA rate we’re talking about here is the initial rate paid by the customer in the first year of system operation. Longer term lengths and higher escalation rates in the agreement lower this initial rate in year 1. In most cases, PPAs need to deliver customer savings of at least 10% in the first year. When this doesn’t happen, it’s hard for PPAs to work. So this evaluation is useful for finding out whether or not a PPA is really an option for a particular customer.

At a conceptual level, the table above summarizes how auto pricing works and how investor pricing works more generally. You need inputs for all of these variables, or at least reasonable assumptions, to estimate what a customer’s PPA rate will be. Our tool is designed to predict the pricing from investors who are the best fit for a particular project. That’s important, because the best fit for a 300 kW deal is often different from a 1 MW or a 5 MW deal.

One of the things that we enjoy at Conductor is helping developers and EPCs succeed with new types of projects. Part of this is finding the right financing partner, but part of it is also working through pricing scenarios to make the project economics work. If a deal doesn’t work with a 20-year PPA at a 1% escalator, how about a 25-year PPA with a 1.5% escalator? We help developers and EPCs hone in on the terms that will maximize their chances of success in achieving the customers’ objectives and their goals as a company.

In the next post, we’ll outline a step-by-step approach for pricing customer PPAs. It’s a way for C&I developers and EPCs to present customers with third party ownership options alongside cash purchase and loan options - even very early in the sales process. We help sales teams do this with confidence, supported by the accuracy of auto pricing and the investor bids that inform it.