ITC Transferability Impacts

The solar industry is still awaiting guidance on most things related to the Inflation Reduction Act (IRA). We expect details on the ITC Transferability and Direct Pay provisions by mid-February, and while we don’t know the details yet, here are the market impacts we expect to see.

Direct Pay

The big change here is that non profits and tax exempt entities will be able to use the tax credit value in the form of a direct cash payment by the IRS. This is great news for the industry and will unlock a ton of projects across the country. We hope that the upcoming guidance will clarify the mechanics for how and when those entities get their check.

Market Impact:

1) We expect the market for customer-owned projects with tax-exempt entities to grow rapidly in states that disallow PPAs. Net metering constraints may temper the growth, but overall there’ll be a net increase.

2) The market will begin offering short-term “bridge loan” products to help float the value of the ITC until the direct payment comes through from the IRS, which could take up to 18 months.

3) Leases may become a more popular contract structure, particularly in states that disallow PPAs. Leases are a simple and known structure for most entities, but historically have run into problems with tax exempt entities as the value of the tax credits would be wasted. Operating leases (off balance sheet) and capital leases (on balance sheet) could both be primed to grow in popularity.

ITC Transferability

Anyone familiar with solar project financing knows how hard it is to use the tax credits as previously designed. For-profit companies who buy the solar system outright end up with a huge tax credit that they often are unable to use immediately, which hurts their ROI. And for any investors trying to monetize those tax credits, you can get buried quickly with phrases like “passive income” or “widely-held C-Corps” or even “the 100-hour test.” This has created an industry reliance on a few specialized firms who invest tax equity into projects and often only work with the biggest and best projects / project owners. The new ITC transferability rules should allow for any system owner with credits to transfer them once without having to worry about the complicated tax equity investment structure.

Market Impact:

1) For-profit companies unable to use the tax credit will now be able to either fund the whole deal through a PPA or just sell off their tax credits at a discount and own the system directly.

2) Solar developers and installers who have always dreamed of long-term cash flows via a PPA now have a much simpler path to making that happen. They’ll be able to offer a PPA directly to their customers and can sell off the tax credit to help fund the project.

PPAs and a third-party ownership structure will still be the best incentive-aligned way to finance a mid-market solar project in many cases. Fortunately now there are a few other viable, competitive options.

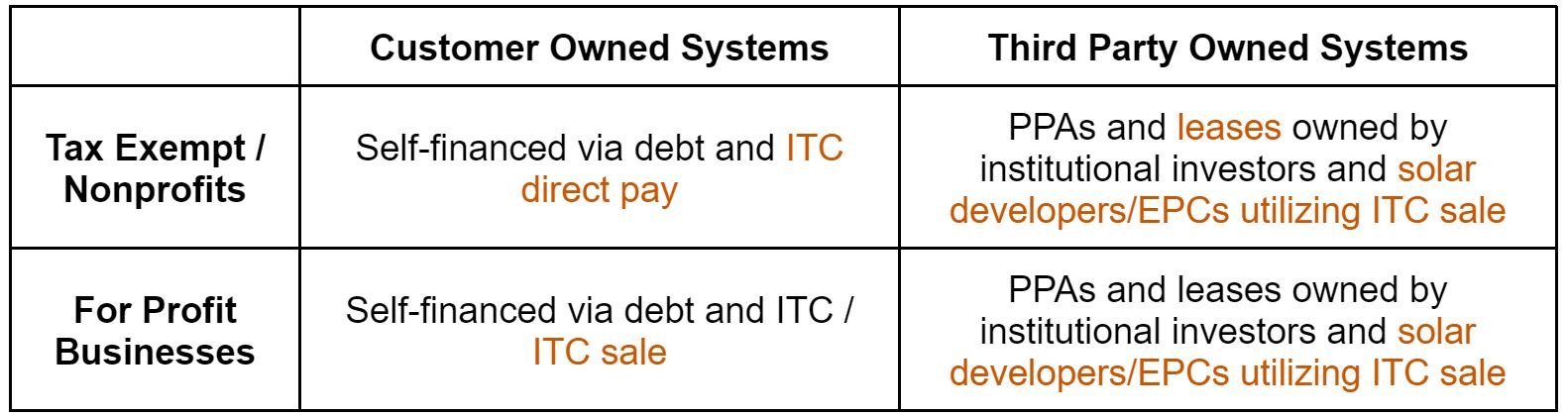

Financing Options by Project Type (new opportunities due to the IRA in orange)