The PPA Financing Process - An Updated Overview

Note - this is a refreshed post, originally made in April 2022. It incorporates the relevant aspects from the Inflation Reduction Act.

Download the complimentary PPA slide deck that accompanies this post (Click Here)

In part two of this series on selling power purchase agreements (PPAs), we’ll outline what to expect during each step of the process. For Conductor’s take on what PPAs are and when to use them, visit our blog post on the first part of the series located here.

Financing PPAs from Start to Finish

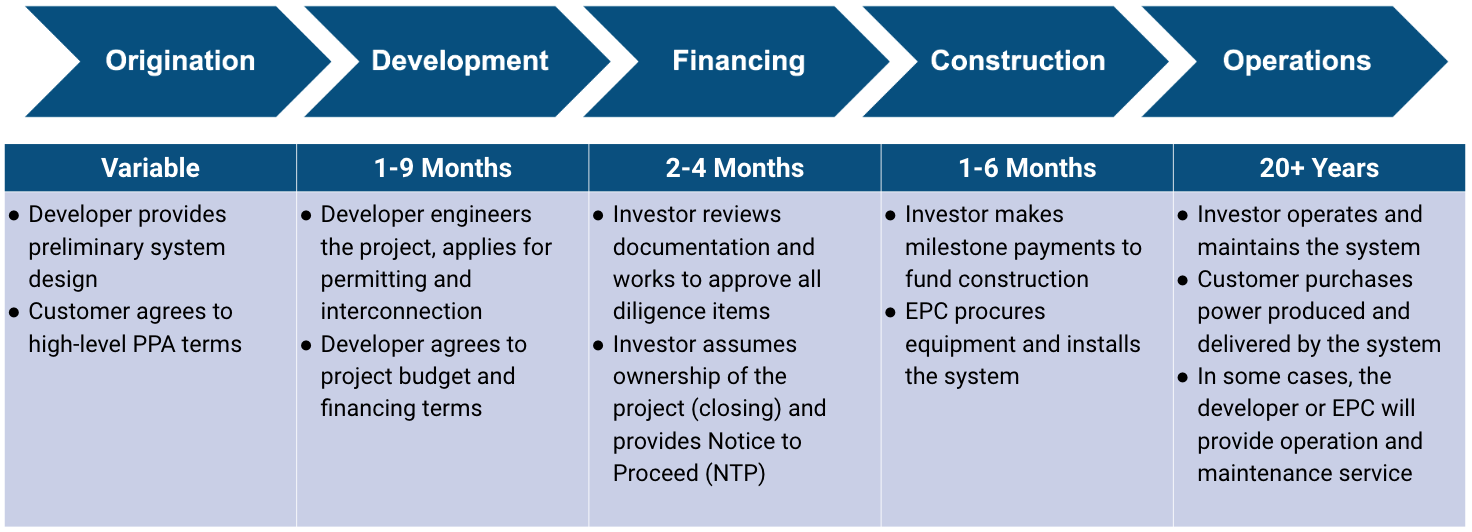

There are five main phases to C&I PPA projects, as seen in the table below: origination, development, financing, construction, and operations. Each of these steps has key deliverables and actions performed by the developer, the customer, and the investor. For Conductor’s take on these and other roles, see this post on solar terminology.

The process can take anywhere from a few weeks to over a year. Every investor would like to make this as short as possible. However, the highly customized nature of these systems necessitates a detail-oriented approach to diligence and acquisition.

Origination

In the origination phase, the developer sells the customer a PPA. This requires a preliminary system design and production estimate and often a PPA price provided through Conductor Solar. An estimated price can serve as a starting point, but a firm price quote for the customer should be provided directly by an investor. In some instances, origination is broken into a few key steps:

Developer designs the system and runs auto pricing on Conductor to estimate a PPA rate for the customer

Customer decides that a PPA is a better fit than owning the system, and provides information to indicate creditworthiness

Developer works through Conductor Solar to get a PPA quote from an investor

Developer, investor, and customer agree on the PPA rate and the high-level terms

Development

Once a PPA price is agreed upon with a system design in mind, then the real work begins. The developer continues to advance the project with a focus on the items needed for investor diligence and the required construction permits. The developer's main role in this phase is to finalize system specifications via engineering drawings and documentation, obtain approvals for permitting and utility interconnection, and complete any required environmental testing based on the type of system.

A key outcome of the development phase is an agreement between the developer and the investor on contract terms. This typically includes the schedule for milestone payments, the amount of the EPC contract and the Developer’s fee, and how these will change if the project changes. The result of these negotiations is a term sheet or Letter of Intent (LOI) between the developer and the investor. While this LOI can be entered into at any point during the origination and development process, a general rule of thumb is that the further advanced the project is, the more value it will command from an investor.

The customer remains involved throughout this process too. The investor works directly with the customer to negotiate the legal terms of the PPA and site easements, and the customer provides access for on-site assessments throughout the development and financing phases.

Financing

During the financing and diligence process, the investor confirms the key system parameters. Investors mainly focus on verifying the inputs to their financial model (e.g., production estimates, revenues, expenses, etc.) and ensuring that no unexpected risks are present (e.g., customer credit, environmental risk, technical risk, etc.). The following table outlines the items that investors will typically review prior to finalizing their acquisition of the project:

Investor review of diligence items often takes 2-8 weeks after the completion of all development work. The diligence timeframe may be longer if development items need to be completed. Conductor often sees projects that still have engineering reports outstanding (e.g. ALTA, Geotech, Phase 1 ESA, etc.) take as long as 20 weeks to close. Outliers exist on either side of this timing, but the goal is always to close as soon as possible. Diligence ends with executed project documentation, and the system is ready for construction.

Update following the Inflation Reduction Act

Investors often will provide a few different price scenarios depending on the expected ITC %. This can be challenging as the final ITC % may not be firmed up via policy or precedents until the system is built. Investors understand that, but they typically will agree to up-front pricing based on the lowest expected ITC scenario with firm pricing improvements that kick in as soon as higher ITC amounts are confirmed.

Construction

In the construction phase the EPC builds the system. Investors generally pay for development and construction with milestone payments specified in the EPC agreement and sometimes a distinct agreement between the developer and the investor. The following table outlines a typical structure for milestone payments:

This table approximates Conductor’s view of the most common set of milestone payments. However, there are a few reasons these may vary:

Developer needs a payment pre-NTP to finalize some of the development work

Investor purchases equipment on behalf of the EPC

Milestones are condensed into fewer milestones for exceptionally small projects and expanded into more milestones for larger projects

In some cases, developers and EPCs have access to construction financing and will fund the construction themselves to receive a higher price from an investor (due to the investor not taking on any construction risk or interest expense).

During active construction, investors often require weekly progress updates to ensure milestones are met and construction proceeds smoothly. They usually want to visit the site or have their independent engineer partner visit the site to confirm mechanical and/or substantial completion. Conductor recommends EPCs capture numerous pictures of the installation process along the way to minimize surprises later on.

After the system is constructed, the EPC commissions the system and completes system performance testing to validate that it works properly. Investors expect to own the system for 20+ years, so the goal of the testing is to make sure that there are no hidden problems in the installation and that the system performs as expected. Typically, systems must meet a minimum level of performance versus expected (e.g. 98%) or else the EPC is subject to penalties.

Operations

The previous steps in this process are designed to set up a 20+ year period of operation with minimal interruptions or surprises. The investor owns the system and gets paid for the power produced, and the customer pays for the power received from the system. The investor also contracts for ongoing operation and maintenance (O&M), which involves active monitoring of the system and periodic inspections required to maintain equipment warranties. If any issues arise, the investor works to remediate them so that the system continues producing power.

One of the key benefits of a PPA agreement is this alignment of incentives between the investor and the customer. The customer wants to keep buying power from the system, because it’s less expensive than the rate from their electric utility. The investor wants to keep producing this power for their key revenue stream as a system owner. And the investor, as the long-term owner, has all of the data and access and contracts to maximize production and deliver this benefit to all parties.

The PPA financing process is a multi-stage collaboration between developers and investors. Developers prepared to go through the process are more successful and close deals faster than those that are not. Conductor’s experience with developers, EPCs, and investors across the country informs our approach to helping deals get financed as smoothly as possible.

Contact Marc Palmer (marc@conductor.solar) with any comments or questions related to selling and financing PPAs or commercial solar in general.