Power Purchase Agreements: Getting Through the Financing Process

Download the complimentary customer-facing PPA slide deck that accompanies this post! (Click Here)

In part two of this series on selling power purchase agreements (PPAs), Conductor Solar will discuss what to expect during each step of the process. The PPA financing process can be complicated to navigate, and Conductor endeavors to give its partners the tools to prepare them for the post-sale work that project investors typically require before an acquisition is complete. If you’d like to first read Conductor’ take on what PPAs are and when to use them, please visit our blog post on the first part of the series located here.

Financing PPAs from Start to Finish

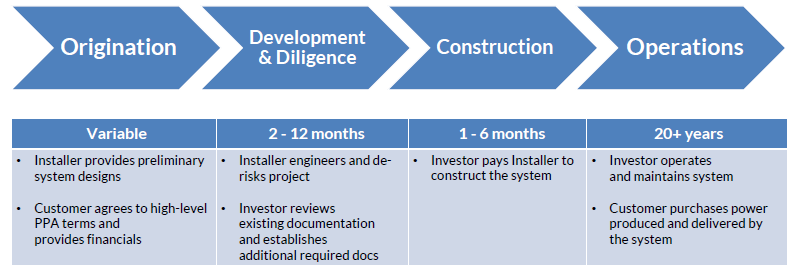

There are four main phases to financing PPAs as seen in the table below: origination, development & diligence, construction, and operations. Each of these steps has key deliverables and actions performed by the installer, the customer, and the investor.

The financing process, just like the sales process, can take anywhere from 4 weeks to over a year. The goal of every investor is to make that process as short as possible. However, the bespoke nature of these systems necessitates a detail-oriented approach to diligence and acquisition.

Origination

In the origination phase, the installer sells the customer a PPA. The installer provides the customer a preliminary design and production estimate—ideally based on a PVSyst or Helioscope simulation—and a PPA price provided through the Conductor Solar platform (an estimated price can be autogenerated in the platform, but a price quoted to the customer should be provided directly by your investor partner). In some instances, this phase is broken into multiple sub-phases:

The installer designs the system and presents it to the customer

Installer and customer decide a cash purchase does not make sense and a PPA is a better fit

Customer provides financials to indicate creditworthiness

Installer works through Conductor Solar to get a valuation and/or a PPA price from their Investor partner

Installer, Investor and customer agree on the PPA rate and the high-level terms of the PPA.

Development & Diligence

Once a system is agreed upon, then the real work begins. Installers must continue to develop the system with a focus on the items needed for investor diligence and the required construction permits. The installer’s main role in this phase is to finalize the system via engineering drawing, interconnection, permitting, and any required testing based on the type of system.

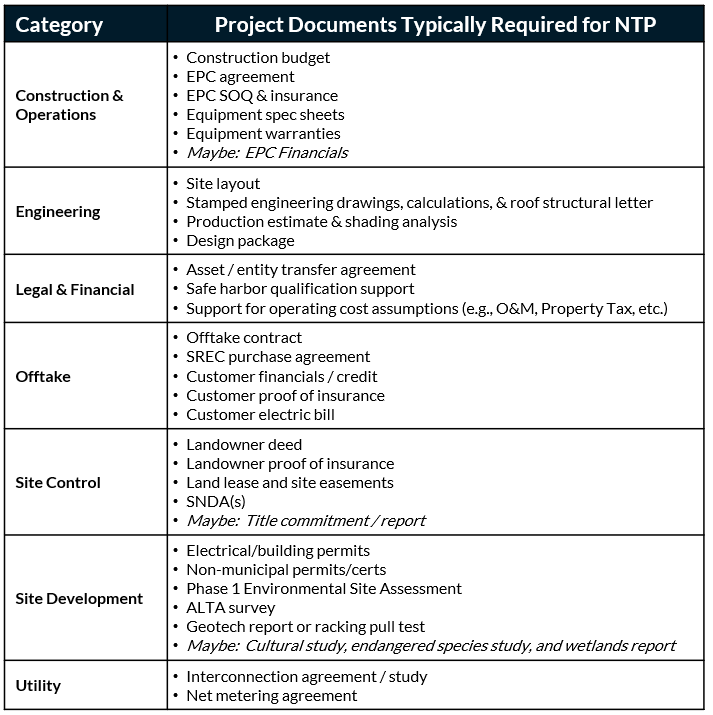

During the diligence process, the investor reviews the key system parameters. Investors mainly focus on verifying the inputs to their financial model (e.g., production estimates, revenues, expenses, etc.) and ensuring no unexpected risks are present (e.g., customer credit, environmental risk, technical risk, etc.). The typical items investors will review prior to acquisition are listed in the table below:

The customer remains involved in this process throughout diligence. The investor will work directly with them to negotiate the legal terms of the PPA and site easements. The customer also provides access for any on-site assessments needed during the diligence phase. Diligence ends with executed project documentation, and the system is ready for construction.

Investor review of diligence items often takes 2-8 weeks after the completion of all development. Depending on when investor becomes involved with the process, diligence may be longer if development items need to be completed. Conductor often sees projects that still have engineering reports outstanding (e.g. ALTA, Geotech, Phase 1 ESA, etc.) take as long as 20 weeks to close. Outliers exist on either side of this timing, but the goal is always to close as soon as possible.

Construction

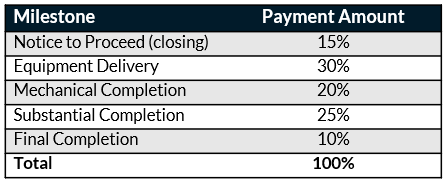

In the construction phase, the installer builds the system. Investors generally pay for construction with milestone payments, negotiated through the EPC Agreement. However, some installers have access to construction financing and will fund construction themselves to receive a higher price from an investor (due to the investor not taking any construction risk or interest expense). A general structure for milestone payments is as follows:

The above table approximate Conductor’s view of the most common set of milestone payments, however, there are some reasons it may vary:

The installer needs a payment pre-NTP to finalize some of the development work

Investor purchases equipment on behalf of installer

Milestones are often condensed into fewer milestones for exceptionally small projects and expanded into more milestones for larger projects

During active construction, investors often require weekly progress updates to ensure milestones are met and construction is going smoothly. They often will want to visit the site or have their independent engineer partner visit the site to confirm mechanical and/or substantial completion. Conductor recommends installers capture numerous pictures of the installation process along the way to minimize any surprises or contentious discussions later on.

After the system is constructed, the installer commissions the system and perform system performance testing to ensure it is working properly. Investors will each have their own requirements for what makes up the performance test, but the goal is to make sure that there were no hidden problems in the installation and that the system is performing as expected. The investor expects to own the system for 20+ years, so they want to know that everything is working at an acceptable standard. Typically, systems must meet a minimum level of performance versus expected (e.g., 98%) or else the installer is often subject to penalties.

The financing process is multi-stage. Installers prepared to go through the process are more successful and close deals faster than those that are not. Conductor uses its market experience with multiple installers and investors across the country to ensure deals are financed as smoothly as possible. Conductor balances reasonableness and fairness to encourage its installer and investor partners transact in a manner consistent with the rest of the market.

Contact Marc Palmer (marc@conductor.solar) with any comments or questions related to selling and financing PPAs or commercial solar in general.