CA NEM 3.0 - C&I Implications

Last month we highlighted a number of positive developments in the middle market from the second half of 2022. Literally the day after we published that post, the CPUC made their final decision on NEM 3.0 in California. It wasn’t what most people in the solar industry wanted. But we’ve put together a few notes to explain what it did, what it means for California’s middle market, and why this is important for anyone in C&I solar.

Here are the highlights:

NEM 3.0 makes customers’ exports of electricity to the grid much less valuable than imports from the grid, except for a few hours in the evening when the sun isn’t shining

This makes battery storage a key compliment to PV systems, and a big part of the economics of any new installation

Once these rates take effect, we expect a shift to a) smaller PV system sizes and b) more batteries paired with PV in behind-the-meter installations

A Little Bit of Background

At Conductor, we help solar developers across the country find and transact with high quality investor partners. We serve the middle market - everything between residential and utility scale, including commercial, C&I, and community solar projects.

NEM 3.0 will impact behind-the-meter installations in CA. In the middle market, this mostly applies to rooftop installations serving businesses, governments, and non-profit organizations. But the change is so drastic, and California’s market is so big, that it’s worth considering the broader implications.

NEM 3.0: What it is and what it does

On December 15th, California made a big change to the way that energy is priced at the edge of the electric grid. This “Net Billing Tariff”, better known as Net Energy Metering 3 or “NEM 3.0”, changes the amount that customers get paid when they send electricity back to the grid.

At any given moment, a customer might be importing electricity from the grid (and paying the utility for it) or exporting electricity to the grid (and getting paid by the utility for it). In many locations with net metering policies these rates are similar, if not identical. In California they’ve been similar too, but they’re about to get wildly different.

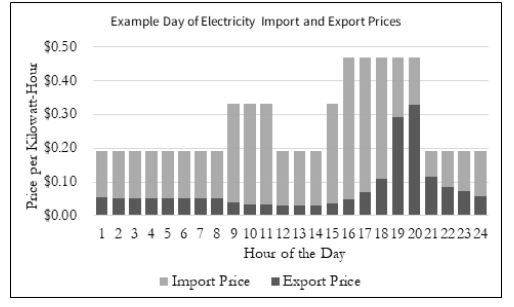

Here’s a graphic from the California Public Utilities Commission that illustrates the spread between import and export prices in NEM 3.0 at different hours of the day:

The lighter gray bars are the import price - what the customer pays the utility. The darker bars are the export price - what the utility pays the customer. But this is a simplified illustration. In practice, rates will be different at different times of the year and change year to year.

The Challenge for Solar Energy

For solar energy, this is a problem. The sun shines during the middle of the day, when export prices are lowest, and sets before the evening hours when export prices are highest. Owners of solar energy systems won’t get much money for sending their excess electrons back to the grid when they’re produced. And the amount of money that they do get will vary, which adds complexity and uncertainty.

This is why the industry opposed these changes so strongly. Now that the changes are decided, we expect a couple of trends in the way that systems are designed and built. That is, after a mad dash for interconnection applications prior to the middle of April 2023, when these changes take effect.

Trend #1: Smaller PV Systems

Solar energy systems behind the meter help customers in a couple of ways. The first is to offset on-site consumption by replacing electricity from the grid with electricity from the PV system. This will still happen at the import rate (see lighter gray bars above). As long as the power from the PV system is used on site, which we call self-consumption, the customer saves money at the higher import rate.

A challenge with this approach is that PV systems designed for self-consumption are much smaller than systems also designed to export. A typical net metered system before NEM 3.0 might have exported about half of the energy that it produced. But to not export energy to the grid requires a system even smaller than half the size.

C&I projects can still be economical with smaller PV systems, and can still get financed. At Conductor, we’ve helped projects as small as 25kW get PPA financing. But it’s harder for customers to get motivated about a system that impacts a small fraction of their electric bill.

Trend #2: More Batteries

Batteries store electricity for use at a different time. When coupled with solar installations they can store excess electricity produced during the day and use it at night - either to offset grid imports in the evening or to export to the grid when prices are highest. Either of these approaches can increase the size of a PV system; they allow the customer to monetize more solar energy at higher rates.

The challenge with batteries is that they are built for specific applications. A battery designed to cycle every day, charging for 8 hours while the sun is shining and discharging for 8 hours after the sun goes down, is very different from a battery designed to export power to the grid for 2 hours during a pricing event that happens a few months out of the year. Chemistry, power electronics, and programming are all optimized for specific charge and discharge cycles - especially with larger systems.

So, we do expect more batteries paired with PV systems under NEM 3.0. But it remains to be seen how many of these are used for self-consumption vs. grid export.

The Bigger Picture

The next time you see a C&I developer who works in CA, buy them a drink. California is already first in line for the Wildest Solar Coaster of 2023, and the year has barely started. Customers who submit interconnection applications before the middle of April can lock in NEM 2.0 - and have every incentive to do so. So we expect a big rush in the first part of the year, followed by a new normal.

This change will be abrupt and disruptive for the market in CA, but it’s unlikely to be an isolated trend. As battery prices decline, distributed solar’s share of generation on the grid increases, and rate structures evolve over time, more and more projects across the country will have to wrestle with similar considerations. There will be a lot to learn.

So thank that developer in CA for leading the charge.

2022 Year in Review: A Tale of Two Halves

What a year! As 2022 draws to a close, we thought it would be good to look back at what happened in the solar markets and identify some lessons on the way. 2022 can be divided into two halves - the first half, where the market faced difficulties, and the second half, where things turned around and really picked up speed.

The beginning of the year saw continuing supply chain difficulties, with developers all over the country facing delays in sourcing modules and other equipment. This was compounded by the uncertainty of the Department of Commerce’s anti-dumping investigation - lots of companies were skittish about making long-term plans with the risk of fines and lawsuits hanging over their heads. As a result, the pace of development was slow, until the Biden Administration announced in June that there would be a 2-year grace period regardless of their final ruling.

With that announcement, things started to pick up, and in August, Congress broke a deadlock and signed the Inflation Reduction Act. This provided an enormous amount of stability for the industry, and the specifics of the law, like an increase in the credit, 10-year extension, transferability, and adders for various specifics, further improved the outlook for solar.

In September, the first SPI / RE+ conference since the beginning of the COVID-19 pandemic saw record-breaking attendance. Our own market research conducted with attendees sees the market doubling in size in the next five years, and doubling again five years later - a real show of optimism from those within the industry!

And as the end of the year approaches, we’ve seen the value proposition of solar vs. traditional utilities continue to improve even in the face of supply chain headaches and global political turmoil. For businesses across the US, solar is saving more money than ever as electricity prices soar by as much as 40%, and the resilience and maturity of the technology was demonstrated by the Florida community that stayed online through Hurricane Ian while their neighbors dependent on the grid went dark.

We’re looking forward to a booming year for solar in 2023, and can’t wait to see what comes next! Hopefully we’ll see additional IRA guidance released shortly to really kick things into gear!

Prevailing Wage and Solar Panel Tariffs Guidance Updates

Updated guidance on the IRA Prevailing Wage rules plus the Commerce Dept’s preliminary ruling on the anti-dumping tariffs.

Solar Panel Tariffs: Dept of Commerce released their preliminary guidance on the anti-dumping case today. Some suppliers were determined to be in violation (BYD, Trina, Canadian Solar, Vina Solar) and some were specifically cleared (Hanwha, Jinko, Boviet, New East Solar). 22 others didn't provide enough info so are still in limbo. Regardless, Washington has waived any anti-circumvention duties for two years, granting reprieve regardless of determination through May 2024. Here’s a link to Norton Rose’s more detailed overview.

IRA Prevailing Wage and Apprenticeship Guidance: Federal ITC prevailing wage and apprenticeship requirements were released and the headline is that investors are able to safe harbor projects through purchasing equipment in advance. This should be very similar to how investors safe harbored 30% ITC projects after it had stepped down to 26% a few years back. It seems like the market will function "as was" for at least a few years on most of these larger projects, assuming there's enough non-prevailing wage labor to support project pipelines. Here’s a link to Norton Rose’s more detailed overview.

Automating Pricing for Mid-Market Solar Projects

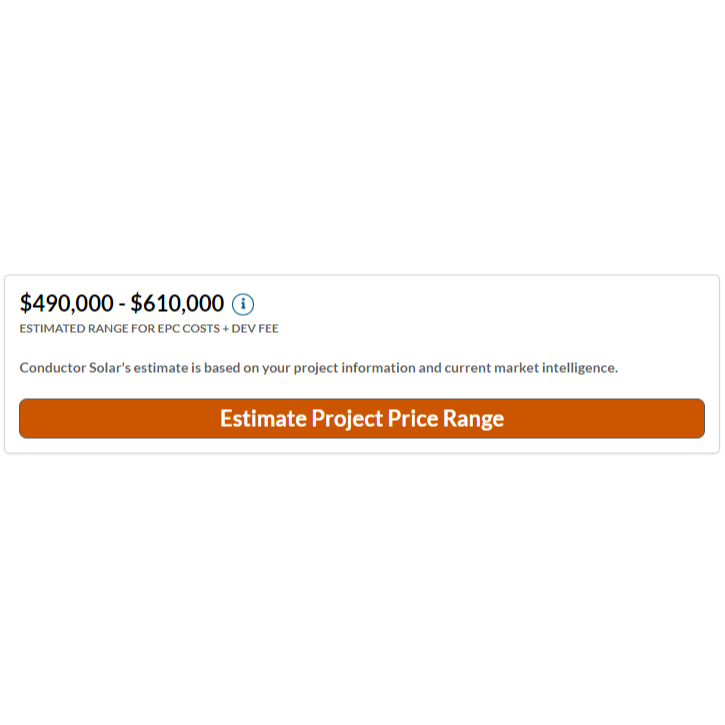

Conductor Solar has an automated valuation model that is free for Developers. We begin to provide a peek behind the curtain as to how this tool is constructed, starting with the fundamental practices.

Conductor Solar makes it easy for solar developers to price their projects with free automated tools. But how do you know it’s accurate? What have we done to make this tool useful for solar projects of all sizes across the country?

I could write a 20-page thesis on project pricing but nobody would read it, so I’ll break it into a few separate posts over the next couple of weeks to keep it digestible. This one is focused on the fundamentals which allow us to automate the process: consistency, accuracy, and representative data.

Consistency: We keep our underlying assumptions consistent such as the dates we use for cash flows and how operating expenses scale with size. As a result, when we notice overall pricing getting better or worse for a given type of project or market, we’re able to quickly dig in to determine if one of our underlying assumptions needs to be adjusted or if this is more of a macro pricing shift (e.g., interest rate hikes driving up overall returns).

Accuracy: Building a solar project has never been easier, but that doesn’t mean that the financials are simple, and we need to be sure our model accounts for as many situations as possible. For example, should you factor in residual value for the solar project after its 25-year offtake contract, and if so, how much? How do you value uncontracted SRECs in Ohio or DC? What premium does a floating discount without any sort of collar command on a community solar project? We’re relentlessly validating our assumptions with the best partners in the market to understand how these situations and many others should be modeled, and our modeling tools are continuously updated with data validation rules and market feedback to help ensure accuracy on every project. After all, garbage in, garbage out, right?

Representative Data: It’s hard to know the market pricing for all shapes and sizes of mid-market solar projects because there are so many differences between these projects. A developer may have their 1,200 kWdc muni project valuations nailed down, but what about a 300kW non-profit? Is that a 50 or 500 bps premium? This uncertainty causes many developers to whiff on pricing proposals by either leaving value on the table, or worse, tarnishing their reputation because they can’t deliver the project at the promised price to the customer. It takes a few valuations to hone in on pricing for a certain flavor of project, and it’s important to keep those fresh as macro changes occur.

Here at Conductor Solar we’re fortunate to have a large dataset and experienced modelers that allows us to address the three fundamentals of project pricing and deliver you automated estimates on demand.

2022 IRA: Mid Market Solar Ownership Trends

With the IRA passage and direct pay now available to tax-exempt entities, will third party ownership stay as predominant in future years as it had in the past?

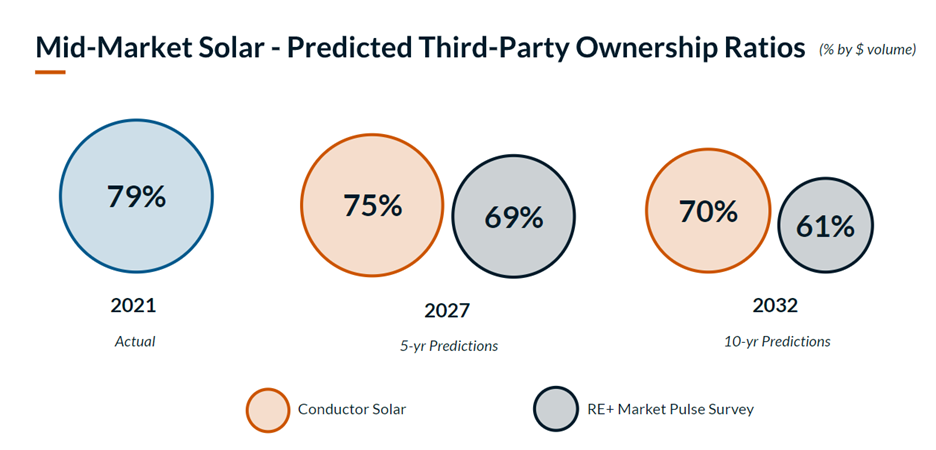

Third party ownership via PPAs, ESA, or leases is the predominant financing structure for the commercial solar market. Is that model going to get flipped on its head as a result of the 2022 IRA and the new direct pay allowance for tax-exempt entities?

Conductor Solar estimates that of all $7.3B US middle market solar projects built in 2021, $5.8B (79%) were financed via a third-party ownership model. The remaining $1.5B were owned directly by the end customer, something we refer to as a “cash deal.”

Now, don’t get that percentage of dollar value confused with the volume of projects. A significantly higher percentage of projects by count were cash deals. However, those tend to have smaller system sizes of $100k-$500k, whereas almost all of the larger projects, such as community solar projects (often $3M-$10M), are financed via third-party ownership.

Pre-IRA, tax-exempt entities were unable to monetize the investment tax credit or depreciation. Third-party owners were able to capture the value of both which provided a much more compelling value proposition. Now, however, tax-exempt entities are able to file for a cash payment from the IRS equal to the amount of the investment tax credit, putting them on a much leveler, if not better, playing field.

So, will they work to pony up the cash or raise the financing needed to own these systems directly going forward? We asked 30 of our industry friends at the recent RE+ conference for their thoughts as to how this ratio may change over the next five and ten years.

Our take is that the middle market solar industry will certainly see a higher amount of cash deals moving forward, particularly among tax-exempt entities like nonprofits and government entities. But there are still many cases where a third-party owned deal is the optimal path.

The two primary reasons for using third-party ownership are 1) these are typically structured as off-balance sheet transactions for the customer, which can be appealing to a CFO, and 2) $500k to $2M solar arrays are too expensive for most organizations to prioritize over core initiatives, but too small to warrant separate financing from their banks. For more details on the PPA structure, including when / why a customer may or may not prefer it, check out our PPA overview blog post here.

2022 IRA: Mid-Market Solar’s Growth Projections

The energy in this industry is through the roof! We explore how various perspectives across the industry expect this to translate to future growth.

Remember your high school physics class? It applies to solar’s middle market… just hear me out! This market appears to be at an inflection point where much of the potential energy FINALLY converts into kinetic energy.

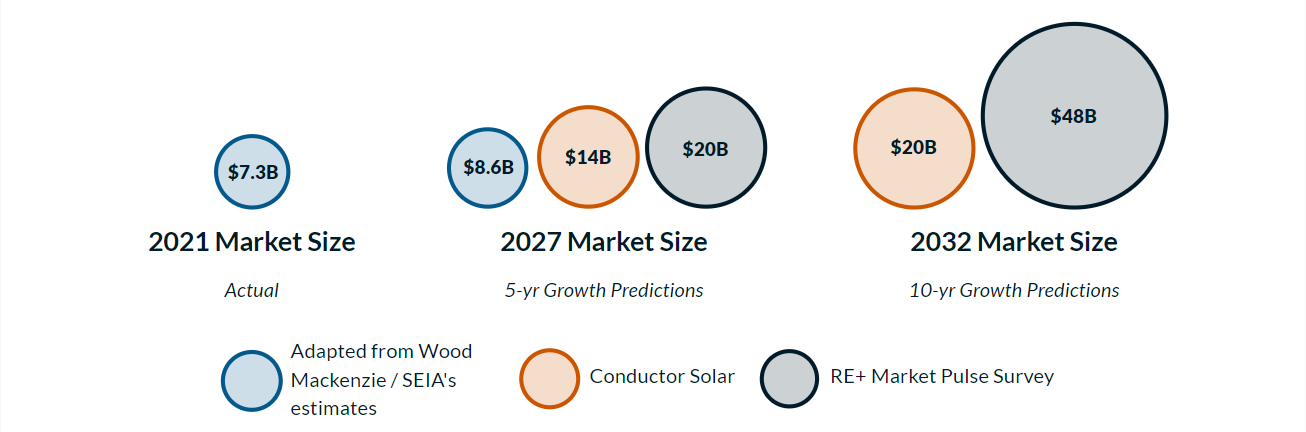

The IRA passed in August, and as you may recall, I took the stance that this market was going to double in five years and triple within ten years. Since then, we’ve seen Wood Mackenzie publish their five-year forecast and we’ve also polled the market directly (30 of our industry friends during the RE+ conference).

To set the stage, when I reference the “Market Size” for solar’s middle market, I’m referencing the cost to build all non-residential projects 5MWac and smaller in the US for a given year. I’ll note that Wood Mackenzie segments the market differently than we do, so we’ve had to apply some creative analysis to interpret their estimates from the always great Quarterly Market Insights Report (#WoodMackenzie - please reach out if you have feedback here or a ten year stance).

Here are the takeaways from this chart:

I’m going to reconsider our estimates given the market sentiment!

This market believes it has a ton of room for growth, hence the potential to kinetic reference. With the passage of the IRA, many players are seeing more projects pencil out and are expecting more opportunities to move forward than ever before

While growth is fun, it also can be hard to manage effectively. Certain aspects of the market (cough - the financing process - cough) will need to evolve in order to handle this growth effectively

Wood Mac references a few macro views such as supply chain delays and state policy caps that they believe will keep this market from truly popping over the short term. While I’m optimistic those effects won’t be as intense (or last for as long), there’s no denying that supply chain disruptions have been an issue in 2022

Some other headwinds that the industry is facing include inflation and interest rate hikes. We’ll work up some analysis in the upcoming weeks to show how these competing forces dampen some of the IRA tailwinds already in place

Have predictions on the market size in five years (2027) and ten years (2032)? Email them to us (info@conductor.solar)! We’ll circulate more detailed stats and ranges to anyone who participates.

2022 IRA: ITC Death and Growth Spirals

Solar Developers are often confused about why their project value erodes more than expected as project economics change. This post elucidates the infamous ITC death spiral and addresses why this turns into a growth spiral thanks to the 2022 IRA.

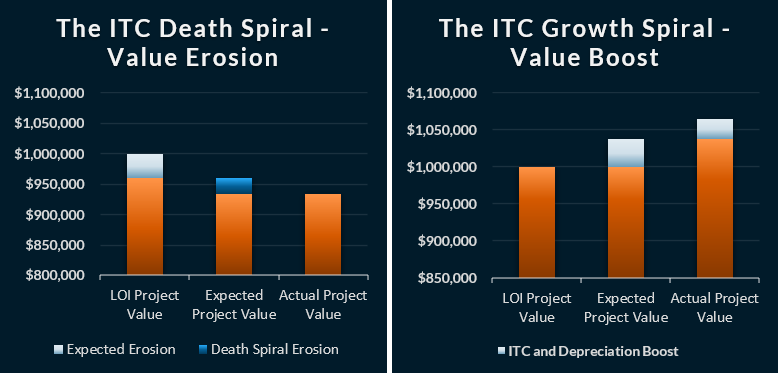

The ITC “Death Spiral” is real. But thanks to the IRA, every mid-market solar developer now gets to realize the ITC “Growth Spiral.” This is the reason that just a 4% increase in the ITC value (26% to 30%) results in a 6-8% increase in project pricing.

First, let’s unpack this Death Spiral. An unfortunate reality of mid-market solar project financing is that diligence often uncovers more negatives than positives. For example, it’s more common for someone to omit a tree which causes shading than it is for someone to errantly insert a tree that doesn’t exist. Whatever the reason, and despite best intentions, it happens (shameless plug: Conductor Solar reduces those odds). As project economics decline, development fees correspondingly decline to keep economics neutral for the investor.

Let’s keep things really simple: imagine that a projected $1M project ends up losing $5k in revenue per year for a twenty-year PPA as a result of unexpected shading. Using a 8% discount rate and a 21% tax rate yields ~$39k in project value that has been erased. So that means the development fee should decrease by $39k and that’s it, right? Wrong…Enter the ITC Death Spiral!

When project value decreases by $39k, that means that the 30% ITC now declines by $11.7k and depreciation benefits also drop the value by ~$5k. So now the dev fee needs to decrease by another $16.7k. Rinse and repeat aka the ITC Death Spiral. The Death Spiral drives the value down by a total of $60k-$70k…ouch!

Now the fun part: let’s see how the ITC Growth Spiral applies. Naturally, if the project revenues increased by $5k per year, you’d see an opposite effect on the project value. That doesn’t happen as frequently, but we did just see an increase in the ITC from 26% to 30% which provides a similar boost. In our $1M project example, the ITC just increased from $260k to $300k. If you add that $40k to the development fee, you now see an additional $13k of ITC benefits and ~$1.7k of depreciation benefits, which again get added to the development fee. Rinse and repeat aka the ITC Growth Spiral. Ultimately, the $40k boost in the ITC should justify $60-$80k in additional project value…much nicer!

I’ll note here that I’m simplifying A LOT as it relates to tax rates, tax investor structures, depreciation details, discount rates, etc. Also, while I assumed everything impacted the development fees, the benefits could also be shared with investors or passed along to offtakers for more compelling sales opportunities.

Hopefully this helps frame up a not-so-intuitive concept that often occurs in mid-market project financing.

You can check out all of our Inflation Reduction Act analyses on the Conductor Solar blog roll.

2022 IRA: Are PTCs Relevant for Solar's Middle Market?

Should mid-market solar deals elect the PTC or the ITC? There’s been a lot of buzz on the PTC being a boost for solar projects, but this post clarifies that while that may be true for the utility scale market, it is not the case for the middle market.

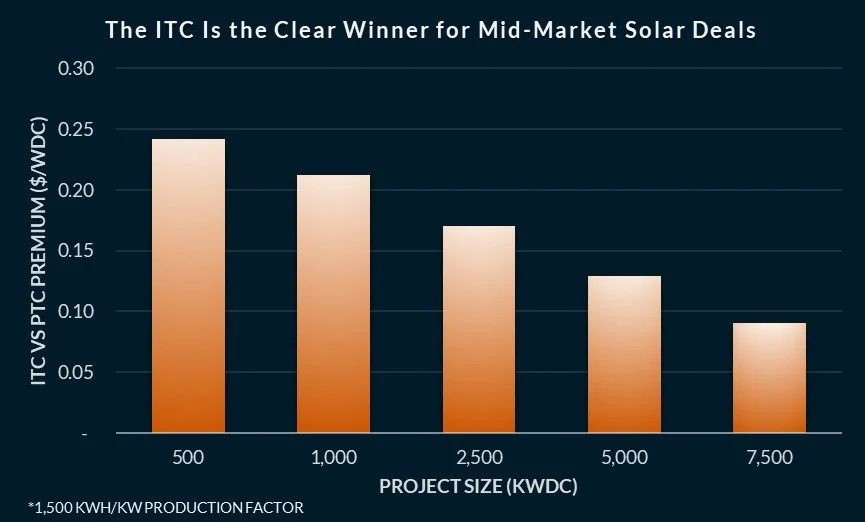

You may have heard that many solar projects will choose Production Tax Credits (PTCs) over the ITC, but don’t be fooled! That’s generally only true for large-scale solar projects. PTCs are essentially irrelevant for projects under 5MW. Here’s why:

ITCs are based on the project budget. As the $/W budget goes down, the ITC becomes less valuable. Utility-scale projects often have a budget at or below $1.00/Wdc, but mid-market projects often have a budget at or above $1.50/Wdc. This makes the ITC for mid-market solar projects >50% more valuable

PTCs are based on production. As the kWh/kW production factor increases, the PTCs become more valuable. Utility-scale projects often use single-axis trackers, bifacial modules, and optimal azimuths, which allows them to approach the limits of efficiency. Mid-market projects often use fixed-tilt or rooftop mounts, monofacial modules, and good azimuths, resulting in production at only 60% efficiency and corresponding generation of 60% of the PTCs per each kW of solar capacity installed

Some other, less impactful reasons also include: 1) Interconnection upgrade costs are now ITC eligible for projects under 5MWac but will not impact the PTCs value; 2) the low income community tax credit adders are only applicable for the ITC; and 3) middle-market solar tax investor partners probably aren't playing in the utility-scale space, so they probably also won’t have familiarity with PTCs

It’s all an efficiency game — the more efficient the budget and production are per kW installed, the more a PTC election would make sense. In the middle market, the only scenarios where we see PTCs potentially making sense are for projects >5MWdc with production factors at or above 1,800 kWh/kW.

Think your project may be the exception? Let’s chat.

You can check out all of our Inflation Reduction Act analyses on the Conductor Solar blog roll.

2022 IRA: Key Takeaways for Solar’s Middle Market

Summary level perspectives on IRA impacts to solar’s middle market.

Players in the solar middle market better buckle up - I’m predicting the market triples in size by 2030.

We’ve taken a stance on the Inflation Reduction Act’s expected impacts to non-residential projects below 5MWdc. We’ll be unpacking many of these in blog posts on Conductor Solar’s website over the upcoming weeks, so keep a lookout.

Overall Market Size: $7B of projects were built in 2021. It’ll exceed $14B in 2026 and approach $20B by 2030

26% ITC to a 30% ITC: This will improve pricing across the board by 6-8%

Interconnection Cost Eligibility: For every $100k in IX upgrades, the project price will increase by ~$70k. This will help more projects to pencil, particularly in the community solar market

Bonus ITCs - 30% ITC to a 40% ITC: This will improve pricing by an additional 15-20% (less any increased costs associated with qualifying for the bonuses)

Bonus ITCs - Domestic Content (10% bonus): Short-term, this will have a negligible effect. It’ll begin making a more meaningful impact on this market in 2025+

Bonus ITCs - Energy Communities (10% bonus): More guidance is needed, but we expect that this will have the most significant impact in the Central Appalachian region (around Senator Manchin’s home state of WV)

Bonus ITCs - Low Income Communities (10-20% bonus): More guidance is needed, but this will be most used by community solar projects. It’ll also drive more mission-focused capital into the market, particularly if non-profit third-party owners can receive a direct payment

Production Tax Credit: This will have a negligible impact on the middle market

Transferability: This will have a negligible impact on the middle market

Direct Pay: We estimate that $1.5B, or 20%, of the $7B market in 2021 were cash deals. That will increase to 25-30% in future as more tax exempt entities can own projects directly

Prevailing Wages: Sub 1MWac projects will take up a larger share of the market. For other projects, this will counter some of the pricing benefits from larger ITCs

Insights from the Conductor Solar Platform

Conductor Solar discusses some market highlights from the past year.

We launched the Conductor Solar Marketplace to help better match commercial solar projects to investors with third-party owned financing. Allowing multiple investors to bid on a project helps developers find the right partner to work with and ensures they get a good deal when they sell their project.

Here are a few highlights of what’s we’ve seen on Conductor as we approach our first anniversary:

We’ve seen a developer increase their developer fee $500k on one project by comparing multiple acquisition bids from investors.

On a 1+MW project, one investor’s bid was 5% higher than every other bid! Price shouldn’t always be the deciding factor, but sometimes it’s impossible to ignore.

A developer obtained a PPA rate on Conductor that was less than half the rate they’d previously been offered by another investor.

Multiple projects that would otherwise not have been sold moved through to acquisition, simply by finding better matches on Conductor.

Developers and investors are telling us that this new way of bidding helps their businesses by making deals happen, giving them new insight into the market, and making transactions easier and more efficient - which is what we’re all about.

The biggest surprise so far is the spread between the prices offered. As mentioned, the lowest spread was only 12%, but for developers that’s still huge! If you net out project expenses including EPC costs, developer fees are typically 10% - 15% of the total budget in a project acquisition. Let’s say developer fees average 10%, and you could get 12% more by using Conductor - you’re more than doubling your dev fee and saving your team time and effort.

And while we love the 1.5MW muni projects, the data points above reflect a variety of projects that don’t lend themselves well to traditional financing models. Projects have run the gamut from churches and nonprofits in the 25-150kW range to municipalities and unrated companies targeting 500kW and up. This underserved market is exactly what Conductor unlocks for developers and investors.

We’re excited about these results, and we’re only getting started - the Conductor Solar team looks forward to sharing more insights as the marketplace grows.

Launch of the Conductor Solar Marketplace!

Conductor Solar Marketplace

One project. Multiple bids.

Our mission at Conductor Solar is to radically grow solar’s middle market. This market has a massive untapped opportunity, and that opportunity will forever remain “untapped” until the financing process is simplified. Otherwise, sub-$1M projects will continue to be burdened with soft costs from expensive staff, attorneys, and consultants. We’ll know we’re on the right path as we hear the definition of “small projects” change from sub-$1M to sub-$100k.

Conductor Solar is becoming the de-facto CRM for external solar project relationships, providing commercial-solar-specific tools to the market, simplifying project financing transactions, and saving our customers 100+ hours on every deal. We intentionally don’t develop projects and don’t invest in projects, but we have a wealth of experience on each side that we’re infusing into this platform.

We’re just at the start of this journey, and the journey will rely heavily on feedback from our developer and project investor customers. Recent customer feedback is what led us to launch the Conductor Solar Marketplace. Here are some of the highlights:

All types of developers were interested in more competition to increase confidence that they were seeing optimal pricing. So long as incremental project investors were still a good fit for that company/project, this would create a more attractive environment for them.

The more experienced developers indicated that while they love the simplicity of the platform and access to great new investor partners, it still was a pain point to communicate with other investors off platform. They wanted to have all their financing partner discussions in one spot, using one set of project data and receiving bids in the same format for those discussions.

Project investors wanted to see more deal flow. Previously, while three investors may have each been a high-quality fit for a given project, only one would see the opportunity. This would result in investors effectively taking 1/3 of possible swings, and it would diminish an investor’s ability to flex up or down based on current pipeline, workload, or hunger to enter a new market.

Now, this doesn’t mean that every project will be matched with 10+ investors for bids. We anticipate that only a few investors will be selected to evaluate each project, as it’s vital that both parties are still only talking to great potential long-term partners. Newer developers to PPA projects may be best suited for only a single investor conversation, while more experienced developers with larger project sizes may command four or five bids. We endeavor to only display high-quality, tailored projects to our project investor customers, noting that those projects may be different shapes and sizes for one investor vs. another.

One concern we heard from both sides was the question “What if I’m matched with a Developer/Investor that I’ve already closed deals with?” This was a legitimate concern, and we made the decision to waive all fees in that scenario. If the companies have closed on a solar project in the prior 24 months, then let us know and we’ll make sure neither side is charged a cent. We want developers to bring their existing investor partners onto the platform, so we needed to make sure that there wasn’t a disincentive to do so. (Note - this only applies for Developers who are bringing new Investors onto the platform to review their projects alongside other marketplace offerings)

While we are confident that the launch of the Conductor Solar Marketplace is the proper next step in our journey, we will continue to seek customer’s feedback to refine and improve it. So hop into Conductor, submit or bid on some projects, and let us know what you do and don’t love about this latest change!

Solar Finance Fund - Unlocking Solar in Central Appalachia

While the number of commercial solar projects has been steadily increasing across the country, Appalachia lags behind. The Appalachian Solar Finance Fund (SFF) was launched in late 2021 to catalyze growth in the commercial and industrial solar sector across the central Appalachian region. Could the SFF validate that, if the economics and policy improved, then demand would increase? And if demand increased, would it increase enough to create additional permanent jobs in the region?

The program is still getting off the ground, but the early indications to those questions are YES and YES! Many fantastic projects across multiple states have been approved by the SFF, and the diversity of these project types is nothing short of amazing:

Projects in KY, OH, VA, and WV are underway or already completed. TN and NC…let’s get some projects moving!

Commercial entities represent both non-profit and for-profit structures. These are organizations such as schools, farms, humane societies, community and event centers, churches, etc.

Projects range in size from $20k to $1M+

Some projects will be owned by a third party (e.g., a PPA or similar structure), while others will be owned directly by the end user

Funding criteria has spanned from a flat 26% of the project cost (replacing the irrelevant federal tax credit due to unfriendly federal and state policies for non-profits) to a workforce apprenticeship program, with many other creative structures in between

The Solar Finance Fund will continue to evaluate funding opportunities on a rolling basis. If you have questions about the program, contact the program lead, Autumn Long (autumn.long@appvoices.org).

Note: Conductor Solar co-founder and CEO Marc Palmer serves as the Financial Review Advisor (FRA) for the SFF. His role is to help validate opportunities and ensure the approved project economics warrant a grant from the SFF.

CEO Marc Palmer on the Clean Power Hour

Listen to our CEO, Marc Palmer, on the Clean Power Hour podcast!

Marc Palmer, our CEO, was recently featured on Clean Power Hour, a leading Cleantech podcast hosted by Tim Montague. Marc and Tim discussed issues facing the C&I solar market today as well as potential solutions to address them. Give it a listen and let Marc know your feedback!

Auto-Pricing on Conductor Solar

Automated project price estimates now available on Conductor Solar!

We’re excited to announce the launch of auto-pricing on Conductor Solar, now available at no cost for all Developers and EPCs!

Here at Conductor Solar, we spend a lot of time listening to our customers so we can understand how to best help them save time and money by getting their commercial deals done faster. One thing we heard over and over again was, “Wouldn’t it be great if we could get pricing estimates before we even start talking with investors?”

We agreed, and we’ve built a one-click tool for developers and EPCs so that you can instantaneously receive an estimated range for either total build pricing or PPA pricing ahead of investor conversations. If you’re not already on Conductor, click here to schedule a demo and get a tour of everything Conductor can offer you!

B-Corp Recertification

New Resource Solutions (Conductor Solar’s parent company) completes it B-Corp recertification!

New Resource Solutions (the company behind Conductor Solar) was founded with a commitment to environmental stewardship, transparency, and accountability. We're always working to save our customers time and money on solar projects, but B-Corp certification shows them we're committed to more than just profits.

So, what’s a B-Corp? As B Lab, the non-profit company which completes the certification, states so well on their website, “B Corp Certification is a designation that a business is meeting high standards of verified performance, accountability, and transparency on factors from employee benefits and charitable giving to supply chain practices and input materials.” Getting certified as a B-Corp requires companies to work for social and environmental good, and it's a rigorous, costly process that involves interviews, lengthy questionnaires, and financial reviews. We’ve got lots of great company as a B-Corp, including some names you might be familiar with: Patagonia, Ben & Jerry’s, and many of our solar compadres such as Third Sun Kokosing Solar, Revision Energy, Solaris Energy and Sunwealth (plus many more you can read about here).

Companies need to get re-certified every three years, and we’re happy to report we successfully completed that process. New Resource Solutions is committed to solutions that work for our customers, our employees, and the environment.

Power Purchase Agreements: Getting Through the Financing Process

This post starts to get into the nitty gritty about what to expect for a PPA financing. It’s important that Developers and EPCs know what’s coming the first time they sell a PPA project, and this post does just that!

Download the complimentary customer-facing PPA slide deck that accompanies this post! (Click Here)

In part two of this series on selling power purchase agreements (PPAs), Conductor Solar will discuss what to expect during each step of the process. The PPA financing process can be complicated to navigate, and Conductor endeavors to give its partners the tools to prepare them for the post-sale work that project investors typically require before an acquisition is complete. If you’d like to first read Conductor’ take on what PPAs are and when to use them, please visit our blog post on the first part of the series located here.

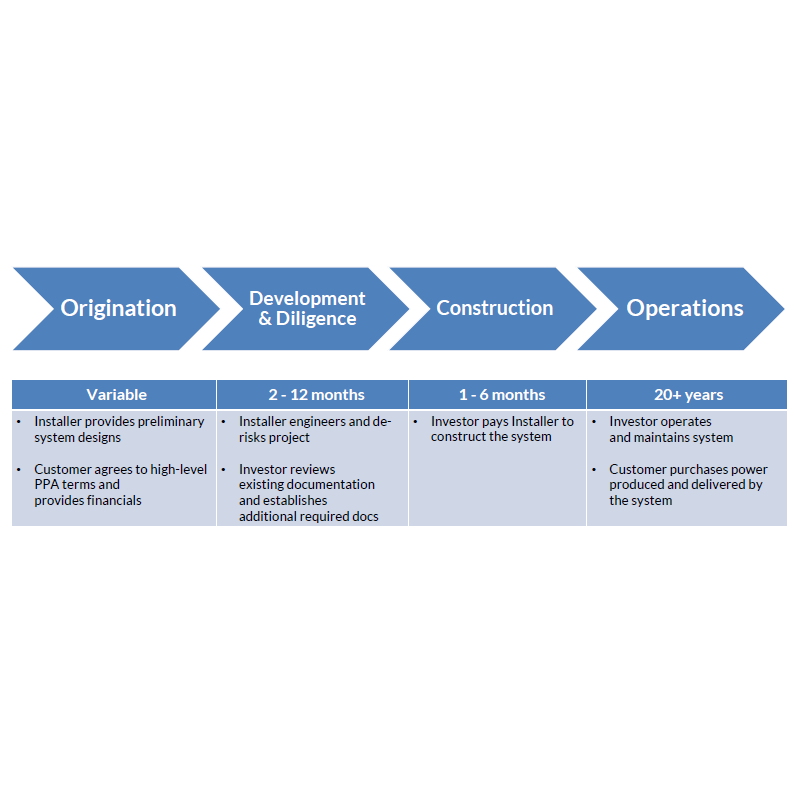

Financing PPAs from Start to Finish

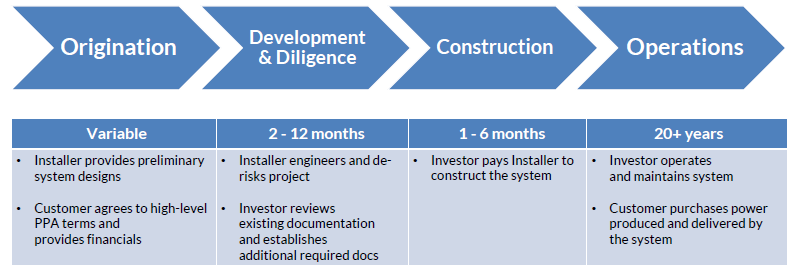

There are four main phases to financing PPAs as seen in the table below: origination, development & diligence, construction, and operations. Each of these steps has key deliverables and actions performed by the installer, the customer, and the investor.

The financing process, just like the sales process, can take anywhere from 4 weeks to over a year. The goal of every investor is to make that process as short as possible. However, the bespoke nature of these systems necessitates a detail-oriented approach to diligence and acquisition.

Origination

In the origination phase, the installer sells the customer a PPA. The installer provides the customer a preliminary design and production estimate—ideally based on a PVSyst or Helioscope simulation—and a PPA price provided through the Conductor Solar platform (an estimated price can be autogenerated in the platform, but a price quoted to the customer should be provided directly by your investor partner). In some instances, this phase is broken into multiple sub-phases:

The installer designs the system and presents it to the customer

Installer and customer decide a cash purchase does not make sense and a PPA is a better fit

Customer provides financials to indicate creditworthiness

Installer works through Conductor Solar to get a valuation and/or a PPA price from their Investor partner

Installer, Investor and customer agree on the PPA rate and the high-level terms of the PPA.

Development & Diligence

Once a system is agreed upon, then the real work begins. Installers must continue to develop the system with a focus on the items needed for investor diligence and the required construction permits. The installer’s main role in this phase is to finalize the system via engineering drawing, interconnection, permitting, and any required testing based on the type of system.

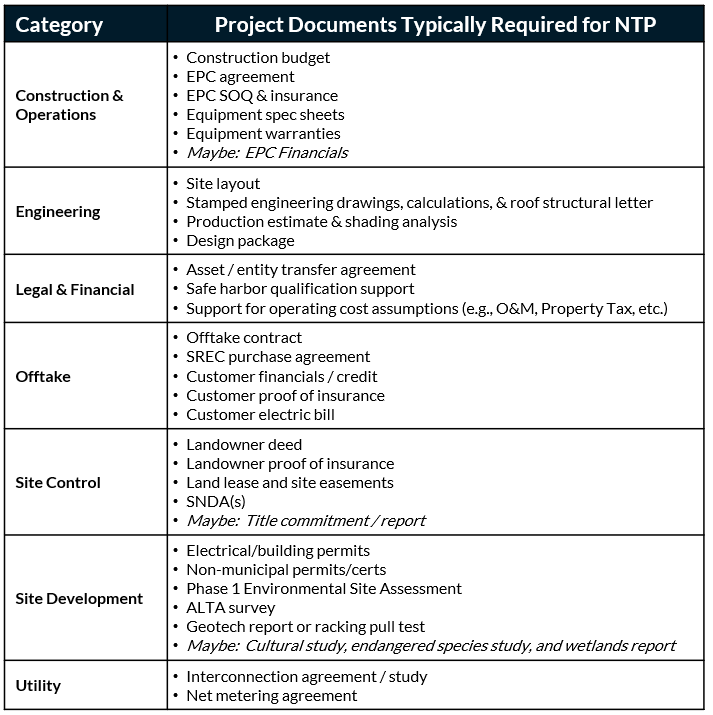

During the diligence process, the investor reviews the key system parameters. Investors mainly focus on verifying the inputs to their financial model (e.g., production estimates, revenues, expenses, etc.) and ensuring no unexpected risks are present (e.g., customer credit, environmental risk, technical risk, etc.). The typical items investors will review prior to acquisition are listed in the table below:

The customer remains involved in this process throughout diligence. The investor will work directly with them to negotiate the legal terms of the PPA and site easements. The customer also provides access for any on-site assessments needed during the diligence phase. Diligence ends with executed project documentation, and the system is ready for construction.

Investor review of diligence items often takes 2-8 weeks after the completion of all development. Depending on when investor becomes involved with the process, diligence may be longer if development items need to be completed. Conductor often sees projects that still have engineering reports outstanding (e.g. ALTA, Geotech, Phase 1 ESA, etc.) take as long as 20 weeks to close. Outliers exist on either side of this timing, but the goal is always to close as soon as possible.

Construction

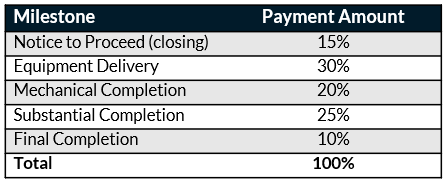

In the construction phase, the installer builds the system. Investors generally pay for construction with milestone payments, negotiated through the EPC Agreement. However, some installers have access to construction financing and will fund construction themselves to receive a higher price from an investor (due to the investor not taking any construction risk or interest expense). A general structure for milestone payments is as follows:

The above table approximate Conductor’s view of the most common set of milestone payments, however, there are some reasons it may vary:

The installer needs a payment pre-NTP to finalize some of the development work

Investor purchases equipment on behalf of installer

Milestones are often condensed into fewer milestones for exceptionally small projects and expanded into more milestones for larger projects

During active construction, investors often require weekly progress updates to ensure milestones are met and construction is going smoothly. They often will want to visit the site or have their independent engineer partner visit the site to confirm mechanical and/or substantial completion. Conductor recommends installers capture numerous pictures of the installation process along the way to minimize any surprises or contentious discussions later on.

After the system is constructed, the installer commissions the system and perform system performance testing to ensure it is working properly. Investors will each have their own requirements for what makes up the performance test, but the goal is to make sure that there were no hidden problems in the installation and that the system is performing as expected. The investor expects to own the system for 20+ years, so they want to know that everything is working at an acceptable standard. Typically, systems must meet a minimum level of performance versus expected (e.g., 98%) or else the installer is often subject to penalties.

The financing process is multi-stage. Installers prepared to go through the process are more successful and close deals faster than those that are not. Conductor uses its market experience with multiple installers and investors across the country to ensure deals are financed as smoothly as possible. Conductor balances reasonableness and fairness to encourage its installer and investor partners transact in a manner consistent with the rest of the market.

Contact Marc Palmer (marc@conductor.solar) with any comments or questions related to selling and financing PPAs or commercial solar in general.

Power Purchase Agreements: How they work and when to use them

This post outlines the basics of a Power Purchase Agreement (PPA) structure for getting solar projects financed.

Download the complimentary customer-facing PPA slide deck that accompanies this post! (CLICK HERE)

Power purchase agreements (PPAs) are an integral part of the commercial solar market, which consists of projects with schools, municipalities, private companies, non-profits, etc. PPAs make up 80% of sales in the annual $5B commercial solar market. However, many installers struggle with the mechanics of a PPA: when to sell it, how to price it, and what to expect after the sale is made. As such, PPAs often end up with a more complicated sales process than their cash purchase counterparts.

In this two-part series (check out part 2 here), Conductor Solar will explain what PPAs are, when to use them, and what to expect during the financing process. For the purposes of this series, Conductor will assume that any system discussed is of sufficient size and creditworthiness to warrant a third-party project investor. In the future, Conductor will provide more guidance on what determines sufficient size and creditworthiness. Conductor endeavors to give its partners the tools to make selling PPAs simpler, as well as to prepare installers for the post sale work that project investors typically require before an acquisition is complete.

How PPAs Work

The primary difference between a cash purchase and a solar PPA is that an unaffiliated project investor owns and operates the system, and sells the power generated from it to the customer for a fixed and known price over 20+ years.

The customer typically receives a 5-20% savings on their cost of power in year 1, with a projected increase in savings over time due to rising utility costs. Under a solar PPA, the project investor receives all the tax benefits associated with the system, particularly the Federal Investment Tax Credit and depreciation benefits. This is important as many commercial entities are unable to use the tax benefits associated with solar, either because they don’t have enough tax liability or because they simply don’t pay taxes

When to use PPAs

PPAs are often the answer for commercial systems due to any number of the large required capital expense, lack of technical expertise or lack of tax appetite of the customer. However, other factors may influence the decision, too. The table below outlines the key determinants for a cash purchase or a PPA:

In both a cash purchase and a PPA, the customer is the system host, just with different obligations. Under a PPA a customer has fewer responsibilities, namely paying their bills and making sure the system owner can access the site to provide required maintenance on the system. The project investor is responsible for insurance, operation and maintenance, repair coordination, and managing incentives.

Discussing PPAs as an Option with Customers

PPAs are not only for those organizations that have low or no tax liability. Some organizations prefer to finance the system and have someone else operate it. Some questions the customer can answer to help with decision making are:

Are you a for-profit organization?

Do you have enough tax liability to use tax benefits from the system?

Does your organization allow you to make a capital expenditure of this size?

Are you comfortable taking on obligations to your balance sheet?

Do you have a loan financing option, and does it provide you with savings/a reasonable ROI?

Is your organization prepared to provide financials to a project investor for credit review?

By understanding the answers to these questions, installers can better help their customers decide whether a PPA is right for them. The biggest difference between financing with a loan as compared to a PPA is that loans represent on-balance-sheet financing and the customer has to carry a long-term liability. PPA payments are treated as an expense, so the PPA never shows up on the balance sheet.

To simplify this process, Conductor developed a decision tree to help guide installers through this often-nebulous sales process. By walking through this decision tree, installers should have no problem helping customers purchase solar in a way that most optimally fits their needs.

In the next installment, we will walk through the PPA financing process in detail. We will focus on a step-by-step explanation of what to expect once the project investor gets involved. Contact Marc Palmer (marc@conductor.solar) with any comments or questions related to selling and financing PPAs or commercial solar in general.

Conductor Solar Announces Partnership with DNV

Conductor Solar partners with DNV’s Solar Resource Compass tool to automatically vet production estimates.

Athens, Ohio: Conductor Solar, an online platform launched this year, is now in the market battling the foe of countless mid-market solar deals: soft costs. In partnership with DNV, the independent energy expert and assurance provider, Conductor Solar now integrates years of R&D on solar industry best practices with DNV’s Solar Resource Compass tool to automatically verify production estimates at the onset of a deal.

Conductor evaluated hundreds of solar projects across the country in 2020, and many were never built due to excessive project costs. According to the National Renewable Energy Laboratory (NREL), soft costs make up 55% of the costs on commercial solar projects, and a large portion of those soft costs are overhead, profit, and contingency. Conductor estimates over $65k per project can be saved if investors, developers, and engineering, procurement, and construction (EPC) firms transacted using a more efficient software platform. The platform has arrived – Conductor Solar – now with standardized and accelerated solar production forecasts from DNV. Conductor Solar delivers a solution to catalyze $395 million in savings per year to end-user customers across the country.

“Conductor sees massive potential in the commercial sector,” states Marc Palmer, CEO, “and with the right tools to cut out soft costs, billions of dollars in new projects will be unlocked each year.”

“By developing analytics to automate the screening of solar energy production forecasts, we’re able to close the gap between development phase assumptions and financing assumptions, ensuring a faster financial close and a more accurate pro forma,” says Jackson Moore, Product Director for Renewable Energy Software at DNV.

Conductor Solar offers solutions for third-party owned projects (power purchase agreements, leases, etc.) nationwide, reducing soft costs in the following critical ways:

Automated, accurate, production estimates with DNV | A solar system is forecast to produce a certain number of kilowatt-hours (kWh) each year, and that production forecast is at the core of the system’s value so accurate estimates are pivotal. With over 2,000 solar EPC firms spread across the country, there’s no standard way those estimates are completed, and hundreds of hours can be wasted on a transaction before gross inaccuracies are uncovered.

Required acknowledgement of industry best practices | Conductor’s experience in solar deal making has allowed them to capture best practices from hundreds of transactions with dozens of counterparties. Developers and EPC firms often have different expectations than investors, and the parties are challenged to align on those in an efficient, consistent manner. Level-setting those expectations accelerates deals from the start and results in fewer speed bumps along the way, saving everyone time and money.

Solar-specific deal rooms | Parties spend dozens of hours today managing their data rooms housed in Dropbox, OneDrive folders, and various other tools. Time gets wasted communicating document needs, tracking what is and isn’t available, and requesting manual status updates over email or with shared Google Sheets. Conductor eliminates those administrative headaches with data rooms focused on the specific needs of commercial solar deals. Each data room has the same look and feel regardless of counterparty while staying flexible enough to accommodate each project’s unique circumstances, and Conductor’s messaging and notification tools reduce time spent on admin, allowing customers to work on more deals.

——————————————————————

About Conductor Solar: Conductor Solar is actively growing the US commercial solar market with innovative software solutions. The company combines extensive solar transactional experience with cutting edge software development to simplify project finance for all parties involved. Visit https://conductor.solar today to simplify your commercial solar deals.

About DNV: DNV is the independent expert in risk management and assurance, operating in more than 100 countries. Through its broad experience and deep expertise DNV advances safety and sustainable performance, sets industry benchmarks, and inspires and invents solutions. DNV provides assurance to the entire energy value chain through its advisory, monitoring, verification, and certification services. As the world’s leading resource of independent energy experts and technical advisors, DNV helps industries and governments navigate the many complex, interrelated transitions taking place globally and regionally in the energy industry. DNV is committed to realizing the goals of the Paris Agreement, and supports customers to transition faster to a deeply decarbonized energy system.

Announcing Conductor Solar!

Conductor Solar launched by New Resource Solutions to simplify C&I solar financing

Conductor Solar is a platform to simplify commercial solar deals

This post can also be found in Solar Builder here.

Athens, Ohio: New Resource Solutions today launched Conductor Solar, a new product designed and built based on best practices from hundreds of solar transactions. The Conductor Solar software platform offers an innovative way for solar developers, Engineering, Procurement, and Construction (EPC) firms, and investors to simplify Power Purchase Agreement (PPA) deals for their commercial solar projects.

“Conductor Solar presents a centralized solution for a very fragmented market,” says Marc Palmer, CEO. “It simplifies a complicated, arduous process and, as a result, unlocks thousands of new solar projects for schools, municipalities, businesses, and non-profit organizations across the country.”

Features and benefits of Conductor Solar include:

Expanded access to solar developers, EPC firms, and investors across the country

Reduced time and money spent on complicated solar transactions

Streamlined information sharing and communications throughout a solar deal

The Conductor Solar platform is open for business and is free for solar developers and EPCs to join. Investors should review the Conductor Solar website for more details. For more information on Conductor Solar, visit https://conductor.solar.