Power Purchase Agreements: Getting Through the Financing Process

This post starts to get into the nitty gritty about what to expect for a PPA financing. It’s important that Developers and EPCs know what’s coming the first time they sell a PPA project, and this post does just that!

Download the complimentary customer-facing PPA slide deck that accompanies this post! (Click Here)

In part two of this series on selling power purchase agreements (PPAs), Conductor Solar will discuss what to expect during each step of the process. The PPA financing process can be complicated to navigate, and Conductor endeavors to give its partners the tools to prepare them for the post-sale work that project investors typically require before an acquisition is complete. If you’d like to first read Conductor’ take on what PPAs are and when to use them, please visit our blog post on the first part of the series located here.

Financing PPAs from Start to Finish

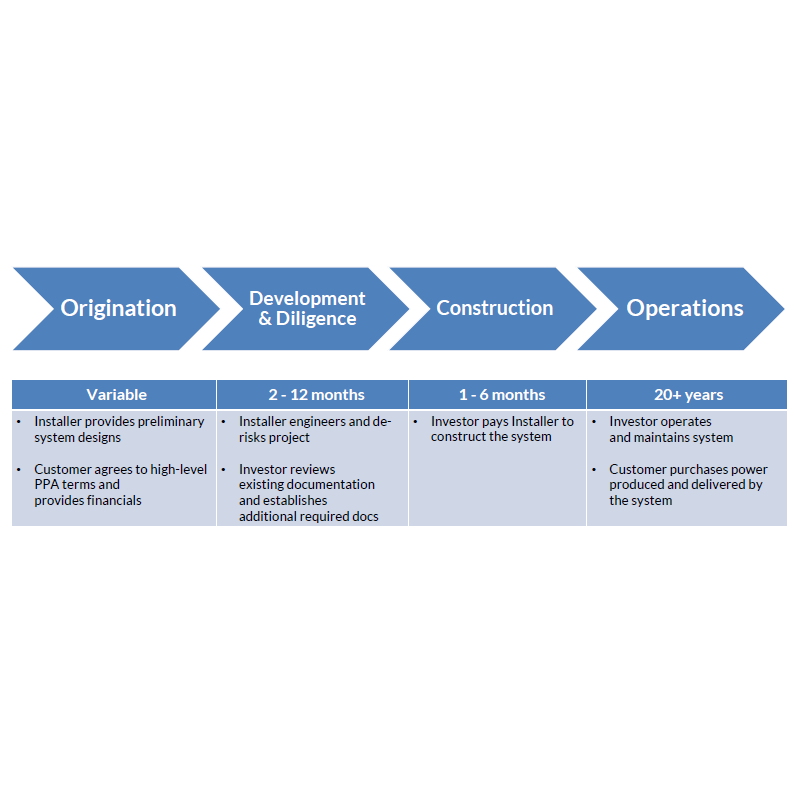

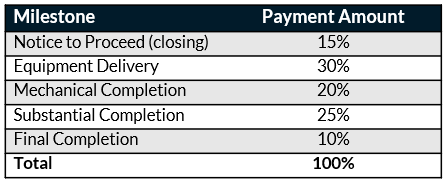

There are four main phases to financing PPAs as seen in the table below: origination, development & diligence, construction, and operations. Each of these steps has key deliverables and actions performed by the installer, the customer, and the investor.

The financing process, just like the sales process, can take anywhere from 4 weeks to over a year. The goal of every investor is to make that process as short as possible. However, the bespoke nature of these systems necessitates a detail-oriented approach to diligence and acquisition.

Origination

In the origination phase, the installer sells the customer a PPA. The installer provides the customer a preliminary design and production estimate—ideally based on a PVSyst or Helioscope simulation—and a PPA price provided through the Conductor Solar platform (an estimated price can be autogenerated in the platform, but a price quoted to the customer should be provided directly by your investor partner). In some instances, this phase is broken into multiple sub-phases:

The installer designs the system and presents it to the customer

Installer and customer decide a cash purchase does not make sense and a PPA is a better fit

Customer provides financials to indicate creditworthiness

Installer works through Conductor Solar to get a valuation and/or a PPA price from their Investor partner

Installer, Investor and customer agree on the PPA rate and the high-level terms of the PPA.

Development & Diligence

Once a system is agreed upon, then the real work begins. Installers must continue to develop the system with a focus on the items needed for investor diligence and the required construction permits. The installer’s main role in this phase is to finalize the system via engineering drawing, interconnection, permitting, and any required testing based on the type of system.

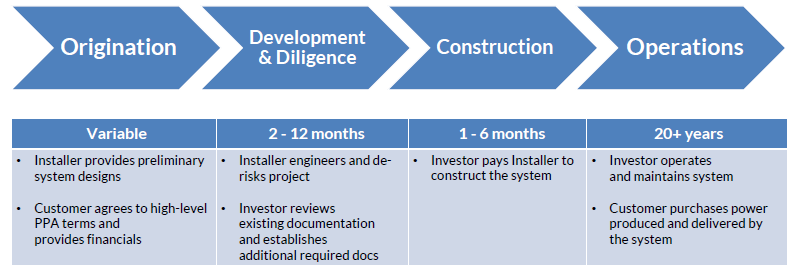

During the diligence process, the investor reviews the key system parameters. Investors mainly focus on verifying the inputs to their financial model (e.g., production estimates, revenues, expenses, etc.) and ensuring no unexpected risks are present (e.g., customer credit, environmental risk, technical risk, etc.). The typical items investors will review prior to acquisition are listed in the table below:

The customer remains involved in this process throughout diligence. The investor will work directly with them to negotiate the legal terms of the PPA and site easements. The customer also provides access for any on-site assessments needed during the diligence phase. Diligence ends with executed project documentation, and the system is ready for construction.

Investor review of diligence items often takes 2-8 weeks after the completion of all development. Depending on when investor becomes involved with the process, diligence may be longer if development items need to be completed. Conductor often sees projects that still have engineering reports outstanding (e.g. ALTA, Geotech, Phase 1 ESA, etc.) take as long as 20 weeks to close. Outliers exist on either side of this timing, but the goal is always to close as soon as possible.

Construction

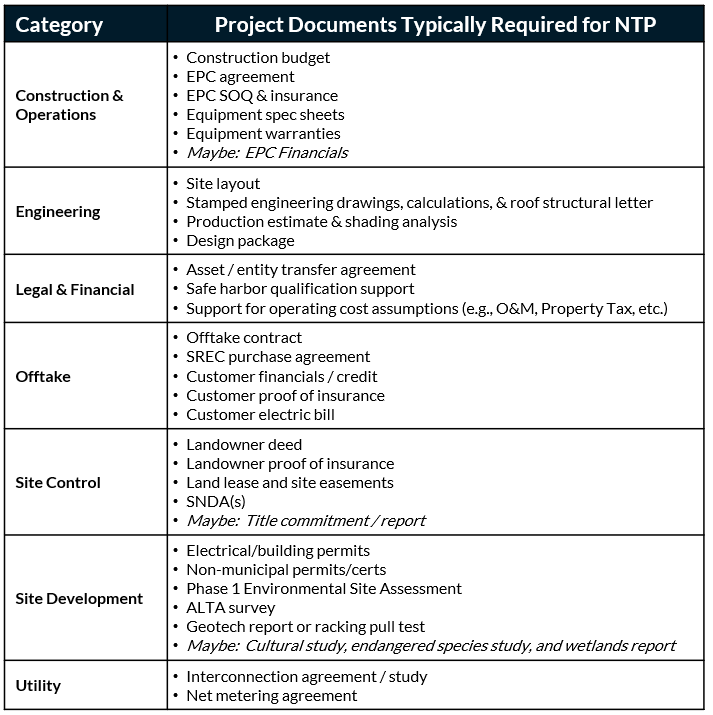

In the construction phase, the installer builds the system. Investors generally pay for construction with milestone payments, negotiated through the EPC Agreement. However, some installers have access to construction financing and will fund construction themselves to receive a higher price from an investor (due to the investor not taking any construction risk or interest expense). A general structure for milestone payments is as follows:

The above table approximate Conductor’s view of the most common set of milestone payments, however, there are some reasons it may vary:

The installer needs a payment pre-NTP to finalize some of the development work

Investor purchases equipment on behalf of installer

Milestones are often condensed into fewer milestones for exceptionally small projects and expanded into more milestones for larger projects

During active construction, investors often require weekly progress updates to ensure milestones are met and construction is going smoothly. They often will want to visit the site or have their independent engineer partner visit the site to confirm mechanical and/or substantial completion. Conductor recommends installers capture numerous pictures of the installation process along the way to minimize any surprises or contentious discussions later on.

After the system is constructed, the installer commissions the system and perform system performance testing to ensure it is working properly. Investors will each have their own requirements for what makes up the performance test, but the goal is to make sure that there were no hidden problems in the installation and that the system is performing as expected. The investor expects to own the system for 20+ years, so they want to know that everything is working at an acceptable standard. Typically, systems must meet a minimum level of performance versus expected (e.g., 98%) or else the installer is often subject to penalties.

The financing process is multi-stage. Installers prepared to go through the process are more successful and close deals faster than those that are not. Conductor uses its market experience with multiple installers and investors across the country to ensure deals are financed as smoothly as possible. Conductor balances reasonableness and fairness to encourage its installer and investor partners transact in a manner consistent with the rest of the market.

Contact Marc Palmer (marc@conductor.solar) with any comments or questions related to selling and financing PPAs or commercial solar in general.

Power Purchase Agreements: How they work and when to use them

This post outlines the basics of a Power Purchase Agreement (PPA) structure for getting solar projects financed.

Download the complimentary customer-facing PPA slide deck that accompanies this post! (CLICK HERE)

Power purchase agreements (PPAs) are an integral part of the commercial solar market, which consists of projects with schools, municipalities, private companies, non-profits, etc. PPAs make up 80% of sales in the annual $5B commercial solar market. However, many installers struggle with the mechanics of a PPA: when to sell it, how to price it, and what to expect after the sale is made. As such, PPAs often end up with a more complicated sales process than their cash purchase counterparts.

In this two-part series (check out part 2 here), Conductor Solar will explain what PPAs are, when to use them, and what to expect during the financing process. For the purposes of this series, Conductor will assume that any system discussed is of sufficient size and creditworthiness to warrant a third-party project investor. In the future, Conductor will provide more guidance on what determines sufficient size and creditworthiness. Conductor endeavors to give its partners the tools to make selling PPAs simpler, as well as to prepare installers for the post sale work that project investors typically require before an acquisition is complete.

How PPAs Work

The primary difference between a cash purchase and a solar PPA is that an unaffiliated project investor owns and operates the system, and sells the power generated from it to the customer for a fixed and known price over 20+ years.

The customer typically receives a 5-20% savings on their cost of power in year 1, with a projected increase in savings over time due to rising utility costs. Under a solar PPA, the project investor receives all the tax benefits associated with the system, particularly the Federal Investment Tax Credit and depreciation benefits. This is important as many commercial entities are unable to use the tax benefits associated with solar, either because they don’t have enough tax liability or because they simply don’t pay taxes

When to use PPAs

PPAs are often the answer for commercial systems due to any number of the large required capital expense, lack of technical expertise or lack of tax appetite of the customer. However, other factors may influence the decision, too. The table below outlines the key determinants for a cash purchase or a PPA:

In both a cash purchase and a PPA, the customer is the system host, just with different obligations. Under a PPA a customer has fewer responsibilities, namely paying their bills and making sure the system owner can access the site to provide required maintenance on the system. The project investor is responsible for insurance, operation and maintenance, repair coordination, and managing incentives.

Discussing PPAs as an Option with Customers

PPAs are not only for those organizations that have low or no tax liability. Some organizations prefer to finance the system and have someone else operate it. Some questions the customer can answer to help with decision making are:

Are you a for-profit organization?

Do you have enough tax liability to use tax benefits from the system?

Does your organization allow you to make a capital expenditure of this size?

Are you comfortable taking on obligations to your balance sheet?

Do you have a loan financing option, and does it provide you with savings/a reasonable ROI?

Is your organization prepared to provide financials to a project investor for credit review?

By understanding the answers to these questions, installers can better help their customers decide whether a PPA is right for them. The biggest difference between financing with a loan as compared to a PPA is that loans represent on-balance-sheet financing and the customer has to carry a long-term liability. PPA payments are treated as an expense, so the PPA never shows up on the balance sheet.

To simplify this process, Conductor developed a decision tree to help guide installers through this often-nebulous sales process. By walking through this decision tree, installers should have no problem helping customers purchase solar in a way that most optimally fits their needs.

In the next installment, we will walk through the PPA financing process in detail. We will focus on a step-by-step explanation of what to expect once the project investor gets involved. Contact Marc Palmer (marc@conductor.solar) with any comments or questions related to selling and financing PPAs or commercial solar in general.

Conductor Solar Announces Partnership with DNV

Conductor Solar partners with DNV’s Solar Resource Compass tool to automatically vet production estimates.

Athens, Ohio: Conductor Solar, an online platform launched this year, is now in the market battling the foe of countless mid-market solar deals: soft costs. In partnership with DNV, the independent energy expert and assurance provider, Conductor Solar now integrates years of R&D on solar industry best practices with DNV’s Solar Resource Compass tool to automatically verify production estimates at the onset of a deal.

Conductor evaluated hundreds of solar projects across the country in 2020, and many were never built due to excessive project costs. According to the National Renewable Energy Laboratory (NREL), soft costs make up 55% of the costs on commercial solar projects, and a large portion of those soft costs are overhead, profit, and contingency. Conductor estimates over $65k per project can be saved if investors, developers, and engineering, procurement, and construction (EPC) firms transacted using a more efficient software platform. The platform has arrived – Conductor Solar – now with standardized and accelerated solar production forecasts from DNV. Conductor Solar delivers a solution to catalyze $395 million in savings per year to end-user customers across the country.

“Conductor sees massive potential in the commercial sector,” states Marc Palmer, CEO, “and with the right tools to cut out soft costs, billions of dollars in new projects will be unlocked each year.”

“By developing analytics to automate the screening of solar energy production forecasts, we’re able to close the gap between development phase assumptions and financing assumptions, ensuring a faster financial close and a more accurate pro forma,” says Jackson Moore, Product Director for Renewable Energy Software at DNV.

Conductor Solar offers solutions for third-party owned projects (power purchase agreements, leases, etc.) nationwide, reducing soft costs in the following critical ways:

Automated, accurate, production estimates with DNV | A solar system is forecast to produce a certain number of kilowatt-hours (kWh) each year, and that production forecast is at the core of the system’s value so accurate estimates are pivotal. With over 2,000 solar EPC firms spread across the country, there’s no standard way those estimates are completed, and hundreds of hours can be wasted on a transaction before gross inaccuracies are uncovered.

Required acknowledgement of industry best practices | Conductor’s experience in solar deal making has allowed them to capture best practices from hundreds of transactions with dozens of counterparties. Developers and EPC firms often have different expectations than investors, and the parties are challenged to align on those in an efficient, consistent manner. Level-setting those expectations accelerates deals from the start and results in fewer speed bumps along the way, saving everyone time and money.

Solar-specific deal rooms | Parties spend dozens of hours today managing their data rooms housed in Dropbox, OneDrive folders, and various other tools. Time gets wasted communicating document needs, tracking what is and isn’t available, and requesting manual status updates over email or with shared Google Sheets. Conductor eliminates those administrative headaches with data rooms focused on the specific needs of commercial solar deals. Each data room has the same look and feel regardless of counterparty while staying flexible enough to accommodate each project’s unique circumstances, and Conductor’s messaging and notification tools reduce time spent on admin, allowing customers to work on more deals.

——————————————————————

About Conductor Solar: Conductor Solar is actively growing the US commercial solar market with innovative software solutions. The company combines extensive solar transactional experience with cutting edge software development to simplify project finance for all parties involved. Visit https://conductor.solar today to simplify your commercial solar deals.

About DNV: DNV is the independent expert in risk management and assurance, operating in more than 100 countries. Through its broad experience and deep expertise DNV advances safety and sustainable performance, sets industry benchmarks, and inspires and invents solutions. DNV provides assurance to the entire energy value chain through its advisory, monitoring, verification, and certification services. As the world’s leading resource of independent energy experts and technical advisors, DNV helps industries and governments navigate the many complex, interrelated transitions taking place globally and regionally in the energy industry. DNV is committed to realizing the goals of the Paris Agreement, and supports customers to transition faster to a deeply decarbonized energy system.

Announcing Conductor Solar!

Conductor Solar launched by New Resource Solutions to simplify C&I solar financing

Conductor Solar is a platform to simplify commercial solar deals

This post can also be found in Solar Builder here.

Athens, Ohio: New Resource Solutions today launched Conductor Solar, a new product designed and built based on best practices from hundreds of solar transactions. The Conductor Solar software platform offers an innovative way for solar developers, Engineering, Procurement, and Construction (EPC) firms, and investors to simplify Power Purchase Agreement (PPA) deals for their commercial solar projects.

“Conductor Solar presents a centralized solution for a very fragmented market,” says Marc Palmer, CEO. “It simplifies a complicated, arduous process and, as a result, unlocks thousands of new solar projects for schools, municipalities, businesses, and non-profit organizations across the country.”

Features and benefits of Conductor Solar include:

Expanded access to solar developers, EPC firms, and investors across the country

Reduced time and money spent on complicated solar transactions

Streamlined information sharing and communications throughout a solar deal

The Conductor Solar platform is open for business and is free for solar developers and EPCs to join. Investors should review the Conductor Solar website for more details. For more information on Conductor Solar, visit https://conductor.solar.